Tristan Bills

New Member

I'm embarrassed to even ask this, but I'm running on two hours of sleep and unable to find anything else in the forums or in my carrier's help files. So any direction would be appreciated.

I have a few InsurTech carriers that provide different replacement cost estimates, I know this is to be expected. They automatically place this in Coverage A and provide an RCE, easy-peasy. Outside of my InsurTech carriers I'm running quotes through the EZLynx rater, but all of them are quoting the Purchase Price for Coverage A.

The first question I have is this, should I enter one of the InsurTech carrier's estimated replacement cost in the Purchase Price field in EZLynx for an adequate comparison of coverage? I'm sure these carriers will have their own estimates before binding. I'm just trying to make sense of it so I can explain it to my clients.

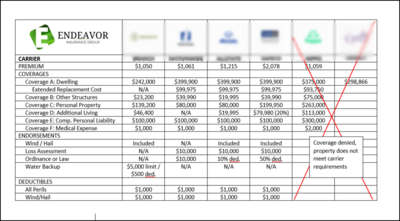

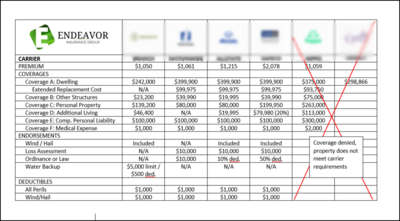

Last question, is there a tool somewhere that can help me create a side-by-side comparison for my clients? Kind of like the image below?

Again, any help is greatly appreciated.

I have a few InsurTech carriers that provide different replacement cost estimates, I know this is to be expected. They automatically place this in Coverage A and provide an RCE, easy-peasy. Outside of my InsurTech carriers I'm running quotes through the EZLynx rater, but all of them are quoting the Purchase Price for Coverage A.

The first question I have is this, should I enter one of the InsurTech carrier's estimated replacement cost in the Purchase Price field in EZLynx for an adequate comparison of coverage? I'm sure these carriers will have their own estimates before binding. I'm just trying to make sense of it so I can explain it to my clients.

Last question, is there a tool somewhere that can help me create a side-by-side comparison for my clients? Kind of like the image below?

Again, any help is greatly appreciated.