PrivClientSG

Guru

- 325

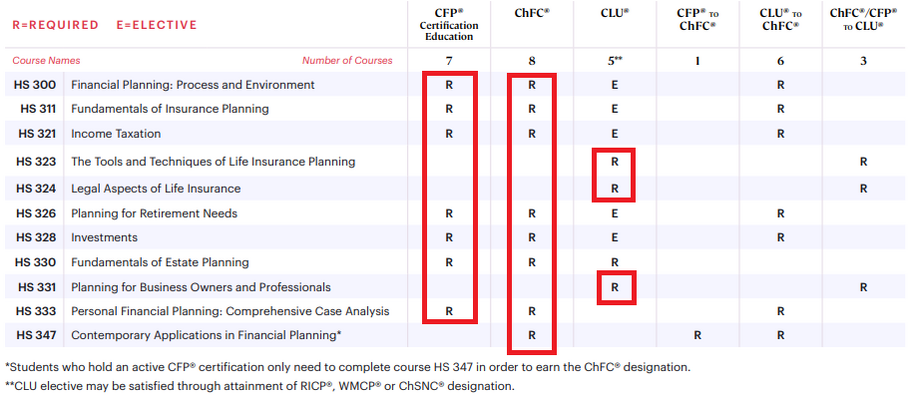

An associate of mine, in the business for 25 years, very sharp, finally wants to get his CFP. He was thinking about starting with CLU and ChFC, but decided to go for his CFP first. He asked me the easiest way to get it? Self-study? If so, with who? Online training? OK, who? Any experience, insight, and perspective would be greatly appreciated. Thank you in advance.