David S Goldstein

New Member

- 2

Good Day,

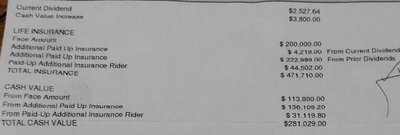

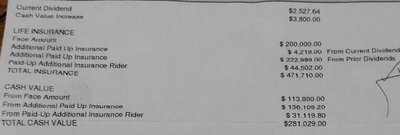

I own the following policy and am curious as to what the full cash withdrawal value of my Whole life policy (see statement attached)? Is it the total cash value or some other line? I am confused by the verbiage.

Additionally, how do taxes work on the withdrawal? Do they count as income or capital gains? Do I pay taxes on the full withdrawal amount or is my initial investment subtracted from what I owe?

Thank you very much in advance

I own the following policy and am curious as to what the full cash withdrawal value of my Whole life policy (see statement attached)? Is it the total cash value or some other line? I am confused by the verbiage.

Additionally, how do taxes work on the withdrawal? Do they count as income or capital gains? Do I pay taxes on the full withdrawal amount or is my initial investment subtracted from what I owe?

Thank you very much in advance