- 4,819

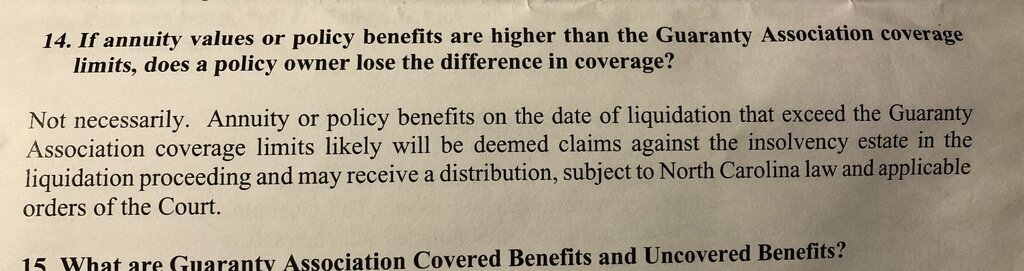

No, I don't mean Guaranty associations. They don't have any assets at all. They will send a bill to other insurance companies in their state that had nothing to do with it to fund the guaranty payments to CBL customersYour state guarantee package of options could include buyers for your assets

I was talking about the liquidation order to CBL to sell all their assets, pay creditors, etc. CBL could own buildings, companies, bonds, mortgages, etc.

For comparison. Say you were a person that won a lawsuit against a business & a judge ordered then to liquidate their assets. They would have to put everything up for sake. All those sales could take months or longer to liquidate assets, especially the assets that have a creditor on the assets as collateral on loan