Peyman Carlsen

New Member

- 6

Hi,

I am wondering how much we should expect to pay for our baby to arrive soon November

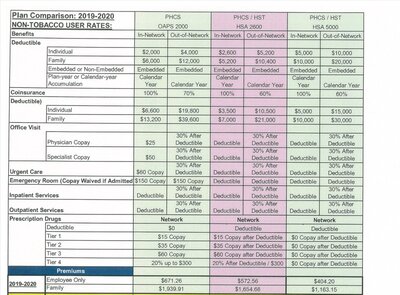

Unfortunately plans in my job renew on October 1st, because the plan I started with since May in this new job was much better.

The new plan is a 2600 CDHP.

Deductible: $2600 Ind / $5200 family.

100% Coinsurance.

Out of pocket max $3500 Ind / $7000 family.

Our plan has me, my wife, and a 19 month old baby. Baby in November will be the 4th member.

I believe that should cover majority of the information needed for everyone to answer my questions.

It doesn't seem like anyone I talk to is 100% sure on what we should expect.

Our HR rep here, calculates the deductible by adding $2600 every time for a member. So he says that right now your family deductible is $7,800 ($2600 * 3 members). So anything after that, the insurance would pay at 100%. And once new baby comes, it would be 4*$2600 = $10,400. But since out of pocket max is $7000, I would only pay $7000? Is this right?

Or talking to the insurance company representative(they never give me straight answer and just use terminology I don't quite grasp) but seems she was calculating based on the Individual deductible. I talked to her when we had the $1000/$3000 deductible, $6,600 ind / $13,200 out-of-pocket-max POS plan, which got removed start 10/1/2019. But still, even though we had a family plan at that time as well, she was somehow using the Individual deductible? I don't want to call her again since I get more lost talking to her. I don't know if they are afraid/liable of giving me straight answer because I might use their words later when I find the bill was more than what they told me...

Could someone please based on the little information about the plan I provided above, say how much we should expect? And I suppose explaining it in simple terms would go a long ways also and appreciated.

Thank You

I am wondering how much we should expect to pay for our baby to arrive soon November

Unfortunately plans in my job renew on October 1st, because the plan I started with since May in this new job was much better.

The new plan is a 2600 CDHP.

Deductible: $2600 Ind / $5200 family.

100% Coinsurance.

Out of pocket max $3500 Ind / $7000 family.

Our plan has me, my wife, and a 19 month old baby. Baby in November will be the 4th member.

I believe that should cover majority of the information needed for everyone to answer my questions.

It doesn't seem like anyone I talk to is 100% sure on what we should expect.

Our HR rep here, calculates the deductible by adding $2600 every time for a member. So he says that right now your family deductible is $7,800 ($2600 * 3 members). So anything after that, the insurance would pay at 100%. And once new baby comes, it would be 4*$2600 = $10,400. But since out of pocket max is $7000, I would only pay $7000? Is this right?

Or talking to the insurance company representative(they never give me straight answer and just use terminology I don't quite grasp) but seems she was calculating based on the Individual deductible. I talked to her when we had the $1000/$3000 deductible, $6,600 ind / $13,200 out-of-pocket-max POS plan, which got removed start 10/1/2019. But still, even though we had a family plan at that time as well, she was somehow using the Individual deductible? I don't want to call her again since I get more lost talking to her. I don't know if they are afraid/liable of giving me straight answer because I might use their words later when I find the bill was more than what they told me...

Could someone please based on the little information about the plan I provided above, say how much we should expect? And I suppose explaining it in simple terms would go a long ways also and appreciated.

Thank You