- 31,143

Congratulations Scott!!!The hospital bill (well, the 1st one) on my 4th child arrived today (born mid August).

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Congratulations Scott!!!The hospital bill (well, the 1st one) on my 4th child arrived today (born mid August).

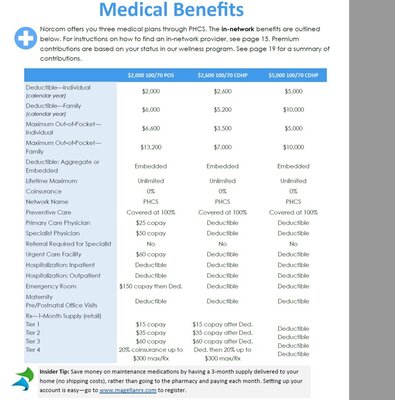

According to that chart, if he has a 100% coinsurance In-Network, then he only has a 60% coinsurance Out of-Network. That desn't make sense. That's a screwy chart.100% coinsurance means you pay 100% until you hit the out of pocket max. Ins pays 0%.

Just like 10% coinsurance means you pay 10%.

100% coinsurance means you pay 100% until you hit the out of pocket max. Ins pays 0%.

Just like 10% coinsurance means you pay 10%.

Ok, well at least I was right even though we were hoping it was only the deductible $2600 and then after that the insurance would pay.

Thank you all for your input and we now have a better understanding of what we should expect.

Ahhh,,, no you've got it backwards. Because if you read it, the out of network would be a 70% out of pocket. Usually what the insurer pays is listed. So in network 100% picked up by carrier after deductible. 70% if you go out of network (insured pays 30%)100% coinsurance means you pay 100% until you hit the out of pocket max. Ins pays 0%.

Just like 10% coinsurance means you pay 10%.

It's embedded which is great. It's 2x deductible, not three. That said at least 2 would have to hit it to waive it for the rest.That's strange.

It looks like you only have 2 deductibles for the family.

I haven't dealt with this type of insurance in years. Maybe one of the experts will take a look.

Now that makes sense, but he's got the middle plan which is 60% OON.Ahhh,,, no you've got it backwards. Because if you read it, the out of network would be a 70% out of pocket. Usually what the insurer pays is listed. So in network 100% picked up by carrier after deductible. 70% if you go out of network (insured pays 30%)

I had to look up embedded deductible, LOL. That's a new term for me. I agree with you, that's the way to go.It's embedded which is great. It's 2x deductible, not three. That said at least 2 would have to hit it to waive it for the rest.

What is nice is that it is embedded. That means each individual can hit the deductible and their out of pocket (x2) and not have to wait for others to push it to the family max. Embedded is the only way to go if you're using this style plan with a family.

Ahhh,,, no you've got it backwards. Because if you read it, the out of network would be a 70% out of pocket. Usually what the insurer pays is listed. So in network 100% picked up by carrier after deductible. 70% if you go out of network (insured pays 30%)

The hospital bill (well, the 1st one) on my 4th child arrived today (born mid August).

My wife hit her oop max of about $6,700.

Have not received any bills yet for the newborn but an Exp of Benefits just came in showing that he has over $4,500 towards his deductible already. Nice. Not sure what all that will be for. Looked like it was anything and everything the hospital and the providers could think of to charge us for.

"Oh, he wanted a cute baby hat? $450 please....don't worry we'll just charge your insurance... We're going to weigh the child. For your convenience, we have a new fee structure. That'll be $750 (100 per lb is the going rate...)"