- 2,455

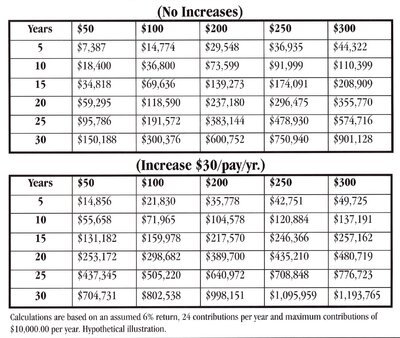

Here is a chart showing 24 contributions per year at 6%. This makes it easier for the prospect/client to see and understand. Perhaps an agent as well. As you can see, it is much easier to get the prospect/client to do something, even a little. Then you bump it up every year. If they are putting in more than they can afford you won't have them as a client for very long. Even if you don't earn a huge amount of money of this, your book of clients is worth money, especially active ones. Another words, you can sell it to someone who is a pro at making it worth more to them than it is to you.

Attachments

Last edited: