I've been selling Real estate Investors WL 10/90. My upline told me there is a better chance for a dividend call with this setup if Dividends go down. In plain English what is exactly a Dividend split? It always seems he wants me to do a 40/60 I assume for commssions.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

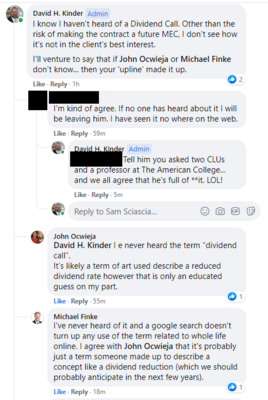

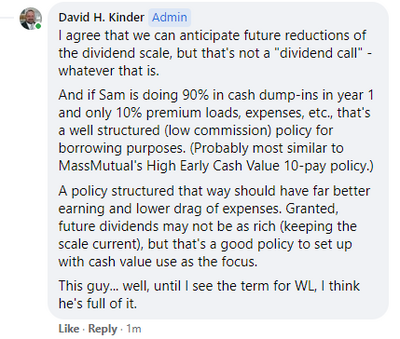

Dividend call

- Thread starter SamIam

- Start date

- 4,575

I've been selling Real estate Investors WL 10/90. My upline told me there is a better chance for a dividend call with this setup if Dividends go down. In plain English what is exactly a Dividend split? It always seems he wants me to do a 40/60 I assume for commssions.

I am interested in knowing what this is also. Never heard of anything referenced this way

- 11,277

Are you selling indexed dividends with Guardian or OneAmerica?

My only thought is that, if the policy doesn't perform to a given minimum, it may not qualify for any interest/dividend to be credited. If you put the company on the hook too much up front, that may be a possibility?

Just my exhausted mind trying to make sense of what this could possibly mean.

My only thought is that, if the policy doesn't perform to a given minimum, it may not qualify for any interest/dividend to be credited. If you put the company on the hook too much up front, that may be a possibility?

Just my exhausted mind trying to make sense of what this could possibly mean.

- 4,575

Are you selling indexed dividends with Guardian or OneAmerica?

My only thought is that, if the policy doesn't perform to a given minimum, it may not qualify for any interest/dividend to be credited. If you put the company on the hook too much up front, that may be a possibility?

Just my exhausted mind trying to make sense of what this could possibly mean.

I wonder if it is being implied that doing 10% of premium going to WL base & 90% to PUAR somehow builds a potential bigger dividend drop someday compared to 40% base & 60% PUAR.

Not sure how that is possible as neither the base or PUAR dividend. Is guaranteed. Maybe some carriers are known to have more change to PUAR dividends.

1 thing is for sure, the 10/90 will have much greater flexibility if premiums can't be paid someday & 10/90 will have more accessible cash value that could be withdrawn, not just borrowed

- Thread starter

- #5

Are you selling indexed dividends with Guardian or OneAmerica?

My only thought is that, if the policy doesn't perform to a given minimum, it may not qualify for any interest/dividend to be credited. If you put the company on the hook too much up front, that may be a possibility?

Just my exhausted mind trying to make sense of what this could possibly mean.

Lafayette Life and Mass Mutual .but we were talking about just the 10/90 design, in general, I agree that is what he was getting at having a policy based on a 10/90 you're in more of a risk for a Dividend call if there is a big drop in dividend. I never heard of it before. He told me it more likely happens more down the road 15 years or so which would make sense if true. But I never heard anybody mention this before. I'm trying to find out if this is true.

- Thread starter

- #6

I wonder if it is being implied that doing 10% of premium going to WL base & 90% to PUAR somehow builds a potential bigger dividend drop someday compared to 40% base & 60% PUAR.

Not sure how that is possible as neither the base or PUAR dividend. Is guaranteed. Maybe some carriers are known to have more change to PUAR dividends.

1 thing is for sure, the 10/90 will have much greater flexibility if premiums can't be paid someday & 10/90 will have more accessible cash value that could be withdrawn, not just borrowed

Your correct but I don't see how it's possible. I'm doing these plans for Real Estate investors and he thinks there should be more base. I don't know if I believe him no one I know has even heard of this.

- 4,575

Ignore him. Real estate clients will need max flexibility. When the market turns or they get some banks calling their loans they will thank you for maxing out the PUAR.Your correct but I don't see how it's possible. I'm doing these plans for Real Estate investors and he thinks there should be more base. I don't know if I believe him no one I know has even heard of this.

I think it is a commission override play & commission needs analysis never plays out well long term

I do recall seeing some videos on Google or YouTube where people pushing infinite blanking concept were saying 40/60 is better than 10/90..........I am still not sold & always gun shy after seeing big cases get sideways down the road when planned premiums don't end up happening

- 10,330

Read the contract. If there is some "loophole" 15 years out with dividends, it will say so.

That being said. In 15 years of selling WL, Ive never heard of it.

Even on a guaranteed basis, a fully overfunded policy will perform better from a Rate of Return standpoint.

The ONLY thing more base helps is agent/upline compensation. And that is exactly why the infinite banker folks who build policies that way do it. Ive heard agents flat out say "it doesnt pay me enough to sell a policy like that so I wont".

----

Who is this person telling you this? You mentioned an upline... if this is an IMO telling you this Id forget this, along with everything else they have told you about life insurance. But you should ask questions to see what the hell they are talking about... most likely they dont know themselves.

If this is your Mass or LL regional telling you this, ask questions and get back to us.

Btw, no reason for an upline for Mass unless they are getting you extra comp... but most likely they are giving you less than if you contract direct with Mass .

That being said. In 15 years of selling WL, Ive never heard of it.

Even on a guaranteed basis, a fully overfunded policy will perform better from a Rate of Return standpoint.

The ONLY thing more base helps is agent/upline compensation. And that is exactly why the infinite banker folks who build policies that way do it. Ive heard agents flat out say "it doesnt pay me enough to sell a policy like that so I wont".

----

Who is this person telling you this? You mentioned an upline... if this is an IMO telling you this Id forget this, along with everything else they have told you about life insurance. But you should ask questions to see what the hell they are talking about... most likely they dont know themselves.

If this is your Mass or LL regional telling you this, ask questions and get back to us.

Btw, no reason for an upline for Mass unless they are getting you extra comp... but most likely they are giving you less than if you contract direct with Mass .

- 11,277

justinahrent

New Member

- 1

What kind of houses do you think I should invest my money in? If you say you invest in real estate, do you have enough experience to answer my question? Or do you always rely only on your intuition and don't think about studying any sources. I haven't worked with real estate yet. I've been investing in Blue-Chip Stocks for about two years now. Some time ago, I was advised to invest exactly in these stocks and study all their sources because it's the right thing to do. And now I was wondering how people investing in real estate do. Do you also read a lot about the future investment object, or only talk to its sellers?

Last edited:

Similar threads

- Replies

- 2

- Views

- 502

- Replies

- 0

- Views

- 580