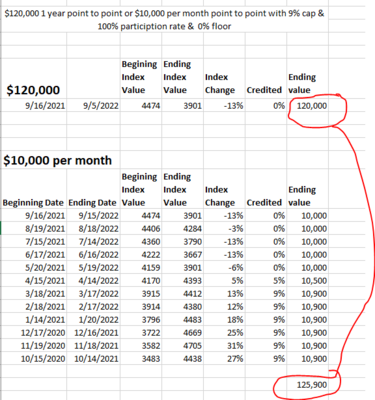

- 10,351

I'm not sure about that, but I am not a math heavyweight.

We may be talking past each other.

I dont know how else to say it.

An annual gain is a 12 month gain.

A 12 month gain is the sum of those 12 months added together.

An annual gain is just the combined 12 months added together.

Yes, its 2 points in time. But those 2 points in time are made up of 13 different points in the middle.