MedicareMutt

Guru

- 375

So I am in NE Ohio ... have Medicare clients ... how do i get a handle on FIA's in this area ..?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I don't know about these yet but I'm thinking a myga is the go to for peeps 65+ ..? You are saying stay away from Variables ..?FIA are not a regional item. They are state wide offerings like a life policy, dependent upon company and it's product offerings in your state.

Are you contracted with a life company who offers FIA's? Start there. Ask if they have specific training on "how" they work, not just how to sale them.

Research here as well. STAY AWAY FROM INDEXED ANNUITIES!... you'll thank me later.

Why?FIA are not a regional item. They are state wide offerings like a life policy, dependent upon company and it's product offerings in your state.

Are you contracted with a life company who offers FIA's? Start there. Ask if they have specific training on "how" they work, not just how to sale them.

Research here as well. STAY AWAY FROM INDEXED ANNUITIES!... you'll thank me later.

What does that mean?FIA are not a regional item. They are state wide offerings like a life policy, dependent upon company and it's product offerings in your state.

Are you contracted with a life company who offers FIA's? Start there. Ask if they have specific training on "how" they work, not just how to sale them.

Research here as well. STAY AWAY FROM INDEXED ANNUITIES!... you'll thank me later.

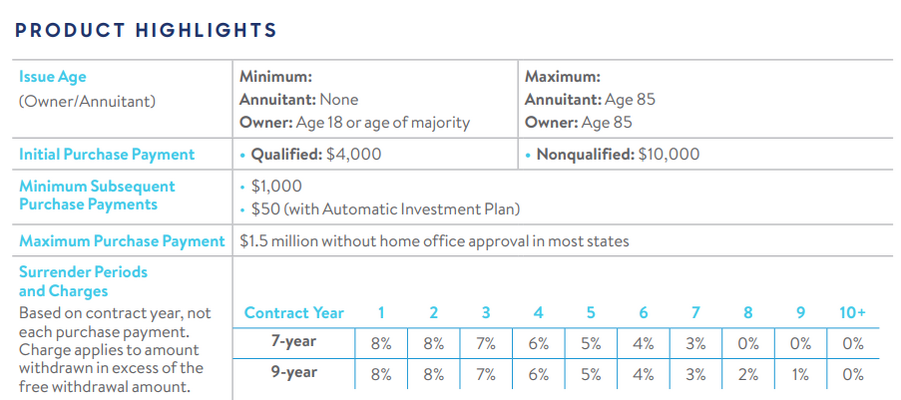

You are looking for an indexed annuity that allows flexible premiums, with a low premium amount. There are 403(b) products that would accommodate similar flows. Outside of that market, Lafayette Life has a couple of indexed annuities that will work if you have a minimum premium of $1,000.00. Otherwise, you are going to have to pay higher premiums. Also- if you want to know more about indexed annuities, you can order my book on Amazon. For someone to teach you about selling indexed annuities...your FMO should do that. Who are you contracted with?Anybody know of companies that have annuities that people can pay $50.00 dollars a month contributions without a larger initial contribution ?

I'm very familiar with indexed annuities and index universal life plans.

I've just had a couple people recently wanting to set up an IRA and they don't have any lump sums right now to contribute but they could do a 50 or $100 a monthly contribution.