- 5,293

And as Ed Slott says: "The tax exemption for life insurance is the single biggest benefit in the tax code."

Absolutely love Ed Slotts info & especially his PBS videos. I believe alot of his views on life pertain to the tax free leveraged death benefit. I am not seen much from him about using as a retirement income tool. I will have to take a new look at it.

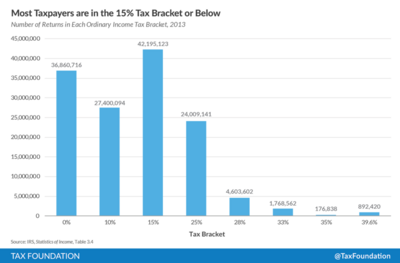

Likely the biggest benefit in the tax code is the standard ded & SS not being taxed for most people, causing 25% of population to pay 0%, 20% to pay 10% & 30% paying 15%. With only around 20% paying 25% or more. And that is all tax payers. Even more weighted on the low end for seniors.