polarbear99

New Member

- 13

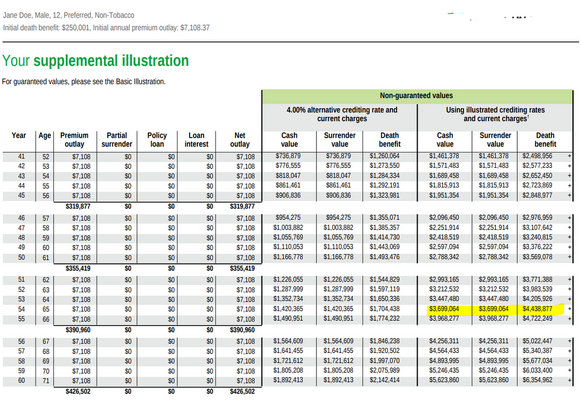

What's the best company with a basic IUL for a healthy child 12 and under?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

2 possibilities in my mind, but with the caveat that parents better be fully protected themselves, have their emergency fund & saving tons for their own retirement in 401k/Roth/their own IUL/College 529Silly Question Im sure - but Why would a healthy 12 year old want an Indexed Universal Life Insurance policy?

Agree! Fund a simple plan, then look for a set aside investment... this leaves the parents with additional options as opposed to locked in long term commitment.Imo, WL works much better for children