- 11,468

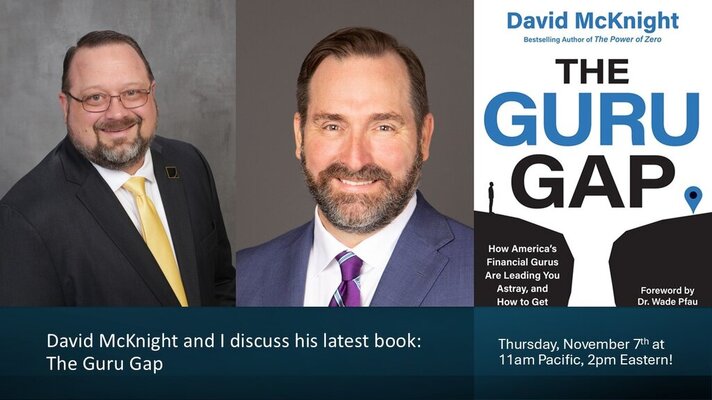

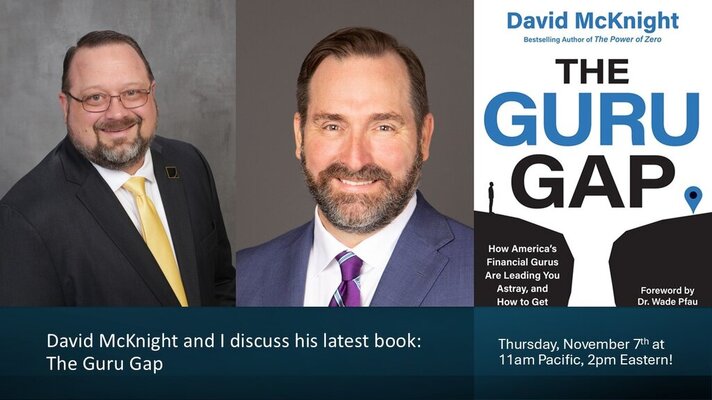

Thursday, November 7th at 11am Pacific, 2pm Eastern!

The Guru Gap Overview

In America, we love charismatic gurus who dispense one-size-fits-all financial advice. In fact, gurus like Dave Ramsey and Suze Orman have gained followers by the millions because of their paint by the number financial strategies that are easy to digest and implement. Through their force of personality and marketing acumen, these gurus have helped millions of Americans eliminate debt and work towards financial independence.

But even as these financial gurus have helped a huge swath of America eliminate debt and save for retirement, rarely has anyone in the mainstream media stopped to ask the question: Is their advice really any good? As I’ve engaged thousands of investors over the last 25 years, a single overarching theme has emerged: the dumbed-down financial advice offered by Dave Ramsey and other gurus is good for bad investors but bad for good investors. It’s good for bad investors because its broad-brush strokes are easy to follow and yield immediate results. But it’s bad for good investors because it’s notoriously short on the sophisticated, math-based strategy required to ensure their retirement savings last through life expectancy.

In short, while financial gurus sometimes dispense good advice, it’s nearly always at the expense of the best advice. The difference between what gurus routinely recommend and what they should recommend is what I call “The Guru Gap.” And it’s a gap into which millions of unwitting investors fall each and every year. This book aims to bridge the gap between what gurus advise, and the proven, math-based principles that will help Americans wring the most efficiency out of their retirement savings.

Click Here to Register

The Guru Gap Overview

In America, we love charismatic gurus who dispense one-size-fits-all financial advice. In fact, gurus like Dave Ramsey and Suze Orman have gained followers by the millions because of their paint by the number financial strategies that are easy to digest and implement. Through their force of personality and marketing acumen, these gurus have helped millions of Americans eliminate debt and work towards financial independence.

But even as these financial gurus have helped a huge swath of America eliminate debt and save for retirement, rarely has anyone in the mainstream media stopped to ask the question: Is their advice really any good? As I’ve engaged thousands of investors over the last 25 years, a single overarching theme has emerged: the dumbed-down financial advice offered by Dave Ramsey and other gurus is good for bad investors but bad for good investors. It’s good for bad investors because its broad-brush strokes are easy to follow and yield immediate results. But it’s bad for good investors because it’s notoriously short on the sophisticated, math-based strategy required to ensure their retirement savings last through life expectancy.

In short, while financial gurus sometimes dispense good advice, it’s nearly always at the expense of the best advice. The difference between what gurus routinely recommend and what they should recommend is what I call “The Guru Gap.” And it’s a gap into which millions of unwitting investors fall each and every year. This book aims to bridge the gap between what gurus advise, and the proven, math-based principles that will help Americans wring the most efficiency out of their retirement savings.

Click Here to Register