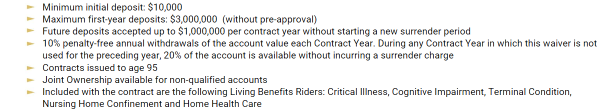

Here is the language from the agent guide for an actual "modern" FPDA.When the carriers set an additional premium cap on a modified single premium product, do they scale the cap expressed in the final contract to the initial premium of the contract or do the just dump in a standard "low ball" number as a future protection for them.

i.e. would they set the same future premium cap for the x months of the additional premium period for a $20K annuity and a $200K annuity?