I'm on the verge of selling my motorcycle because the insurance is what I'd consider 'outrageous' for a weekend bike.

1. Why is it so expensive? is it the classification

2. What can I do to reduce it and have similar coverage?

3. Is it a lost cause and I should sell it?

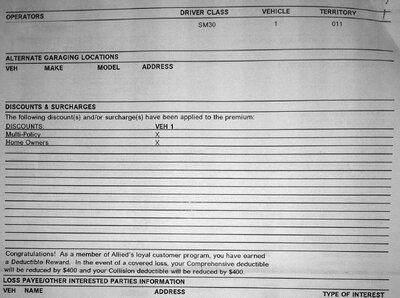

4. What does the SM30 driver class and 001 territory mean?

Thanks so much for any help!!!

-------

Background and history:

30 yr old white male. Airline Pilot. I had 1 car accident 3 years ago that nearly totaled my SUV when I hit black ice in the snow. It was repaired via insurance. No speeding tickets. My plan is attached with my 60 year old parents who own several car and homes and have worked with this agent for many years.

I drive the bike 550 miles a year, 3,300 miles total. It's a garage queen that sits covered and secured 98% of the year.

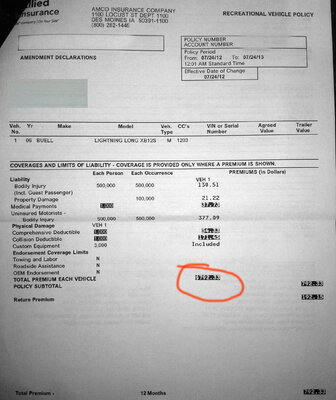

Insurance is now $792 a year or $66 a month. In 6 years I've spent $5,910 on insurance for it. I have 0 claims on it and have never even dropped it. The bike cost me $9,000 used, $10,400 msrp new and is valued KBB at $4,500.

Doesn't make sense financially to own this unless the insurance can be lower. Don't you agree?

I asked my agent to lower the medical payments to $1,000 and that saved $200 a year. My sister/lawyer told me this was ok.

Attachments show my bill and bike

1. Why is it so expensive? is it the classification

2. What can I do to reduce it and have similar coverage?

3. Is it a lost cause and I should sell it?

4. What does the SM30 driver class and 001 territory mean?

Thanks so much for any help!!!

-------

Background and history:

30 yr old white male. Airline Pilot. I had 1 car accident 3 years ago that nearly totaled my SUV when I hit black ice in the snow. It was repaired via insurance. No speeding tickets. My plan is attached with my 60 year old parents who own several car and homes and have worked with this agent for many years.

I drive the bike 550 miles a year, 3,300 miles total. It's a garage queen that sits covered and secured 98% of the year.

Insurance is now $792 a year or $66 a month. In 6 years I've spent $5,910 on insurance for it. I have 0 claims on it and have never even dropped it. The bike cost me $9,000 used, $10,400 msrp new and is valued KBB at $4,500.

Doesn't make sense financially to own this unless the insurance can be lower. Don't you agree?

I asked my agent to lower the medical payments to $1,000 and that saved $200 a year. My sister/lawyer told me this was ok.

Attachments show my bill and bike

Attachments

Last edited: