Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

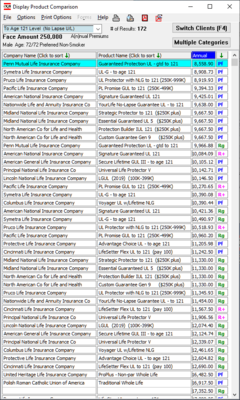

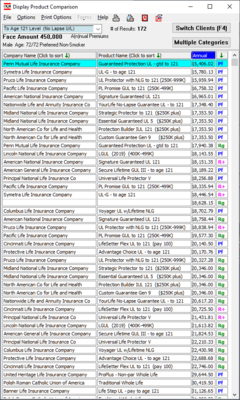

Need help with a WL quote

- Thread starter secondcreek

- Start date

- 5,548

That's pretty neat ... someone should come up with a way to market that kind of quoter.

- 5,801

Why not slop on some FE, cook his rear in the end and place the rest in an annuity with her as the beni.

- 25,037

Just an FYI, the WL illustration was Prf'd NT You Quoted Std NT Now the difference is about $50,000.00 death benefit.

- 4,605

The difference with the par WL... yes the premium will be higher, however the DB will grow. At the end of 20yrs it will likely be $450k, not $250k. So its all in what they want. Cheapest price for level DB would be GUL, as mentioned.

However, the reason GUL is able to be priced lower is that it is known that some will fail to cover the no lapse required premium at some point and it isn't required to have CV equal face at maturity. Some will lapse or be cancelled when someone 80 or 90 cant remember why they bought the product & dont keep paying. It is the absolute only reason GUL or no lapse IUL or no lapse VUL can be priced the way it is. I love it for myself but get worried about average consumers staying compliant long term with no lapse element.

At least with a WL they have the automatic premium loan that could pay the premium in later years on a low div product variation or PUAR-Div pay premiums on better performing WL. Lastly, WL legally has to have ETI & RPU as non forfeiture options which GUL generally doesnt.

So, we wont actually know which one is cheapest until the end.

Last edited:

theleadingagent

Guru

- 381

What is ETI and RPU

- 1,405

However, the reason GUL is able to be priced lower is that it is known that some will fail to cover the no lapse required premium at some point and it isn't required to have CV equal face at maturity.

Lapse assumptions affect ALL products. Actually, a whole life product with high cash values is much likelier to lapse because there is an incentive to go for the cash. A no lapse UL product, which offers the benefits of a low fully guaranteed premium, is more likely to NOT lapse the longer it is in force.

About 35 years ago I bought $350,000 of Canadian Term to 100 (same thing, only different) which has NO CSV and never will. It is lifetime protection with a fully guaranteed premium of about $100 per month for the rest of my life. How inclined do you think I would be to stop paying those premiums?