- 5,326

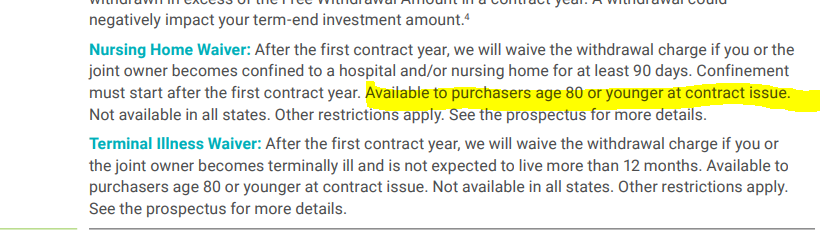

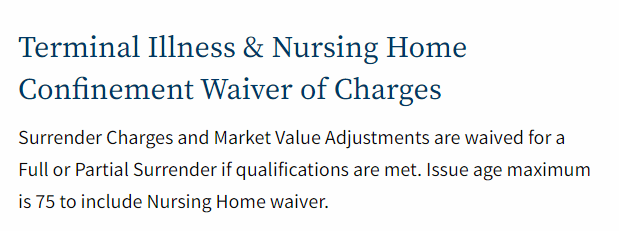

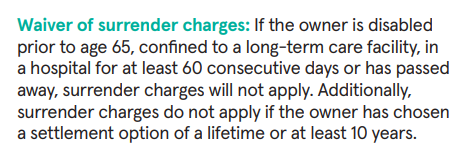

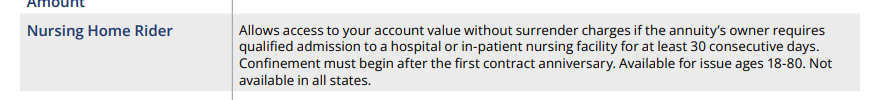

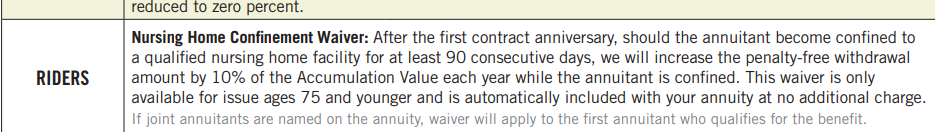

Dont some of those have stipulations on nursing home waiver being connected to age at time of issue? Also, for those with MVA, wont some of them still experience a "defacto" surrender charge if interest rate market has increased since time of purchase/renewal rate lock?Most deferred annuities have a clause allowing complete liquidity if the Owner goes into assisted living.

IE: Buying at age 70 or 75 might allow surrender charge waiver for confinement, but buying at age 90 might not?

5 or 6 examples below that are "age at issue" to be eligible for NHW and/or MVA waiver. Also, pay close attention to contract language as some are specific to being triggered by the owner & some by the annuitant and their age at issue. Could be a tough conversation in some situations if someone goes in a home right after renewing a MYGA with a revolving 5 or 10 year surrender charge & they were too old at time of issue or the spouse is confined but wasnt the annuitant or owner as required by the specific contract language. (this is why there is more to MYGA than just the current interest rate)

PS-- read the sample contract and/or rider contract language for carriers you sell. Dont rely on what your marketing materials show or what you upline in your Annuity IMO says if they havent read the contract language. Imagine if you move a consumers MYGA with a 4.5% rate that would have waived surrender charge & MVA penalty to a new carrier that the NHW wont apply & MVA penalty will because you were chasing new commission rate & a 1/2% more interest rate without disclosing the downside.

Last edited: