- 1,745

Group life agents:

How to persist in requiring employees on the group medical plan to complete a beneficiary form.

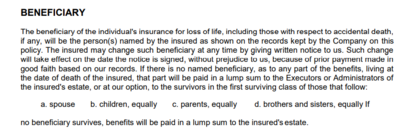

One of my employer groups has a health insurance group plan from a major carrier that is under an association subset of benefits, including life insurance for employee and family. There is no automatic process for the covered employees to complete a beneficiary form.

I recall being required to fill out a beneficiary form when I worked for an employer with about 3,000 employees & there was automatic life coverage on the benefit plan. (my group is about 1.5% of that size).

I once sent them a form I found on SHRM's website. No response. I am pretty sure that their 401K vendor must be requiring this.

How to persist in requiring employees on the group medical plan to complete a beneficiary form.

One of my employer groups has a health insurance group plan from a major carrier that is under an association subset of benefits, including life insurance for employee and family. There is no automatic process for the covered employees to complete a beneficiary form.

I recall being required to fill out a beneficiary form when I worked for an employer with about 3,000 employees & there was automatic life coverage on the benefit plan. (my group is about 1.5% of that size).

I once sent them a form I found on SHRM's website. No response. I am pretty sure that their 401K vendor must be requiring this.