Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Renewal Scam

- Thread starter rats0001

- Start date

- 11,399

It's not a scam.

It's a message of intent.

They want to attract new money and don't want to incentivize existing money to stay upon contract renewal.

It's not uncommon.

It's a message of intent.

They want to attract new money and don't want to incentivize existing money to stay upon contract renewal.

It's not uncommon.

- 10,563

Its also the economics of annuity reserves.

That 3 year old contract is funded with underlying bonds that have a much lower yield vs. the new bonds they would purchase for a new annuity contract.

Even more so if its annually renewable and not locked in for another 3 years.

That 3 year old contract is funded with underlying bonds that have a much lower yield vs. the new bonds they would purchase for a new annuity contract.

Even more so if its annually renewable and not locked in for another 3 years.

- 4,776

Its also the economics of annuity reserves.

That 3 year old contract is funded with underlying bonds that have a much lower yield vs. the new bonds they would purchase for a new annuity contract.

Even more so if its annually renewable and not locked in for another 3 years.

But last I knew, carriers are not buying short term bonds or mortgages to match those short durations. They are investing much, much longer. So, I dont follow why they would want to push money out early to have to send money out the door when the bond or mortgage they bought with it may not come due for another 11 or 16 years.

I saw one carriers portfolio of bond & mortgage expirations & most years only had between 3% & 5% of their bonds/mortgages coming due in that year.

I honestly believe the carriers believe more consumers will stick with the renewals than leave because of the work & effort to leave just like banks believe this. But I dont believe the carriers are realizing how many independent annuity agents X date all their renewals to look for better rates & a new commission compared to a renewal commission, etc.

I may not be correct with my assumptions above, but it is what I have seen. There are really no short term investments for carriers to make to issue an annuity for 3 to 5 years & cover the reserves, the commissions, cost to issue the policies & investment costs. I think they are going much, much longer & planning on most of it sticking.

The bigger concern I have is how much these carriers are investing via offshore reinsurers that are not restricted to same investments as non-offshore investing. that makes me more worried about how aggressive they are being with something being sold as super safe & guaranteed

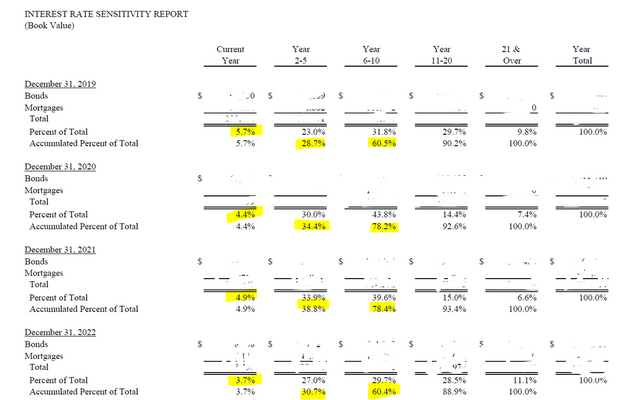

See below, showing only 28%-38% of bonds/mortgages coming due in 5 year period & only 60-78% even coming due in 10 year period. that tells me they are not matching to short duration MYGA like 2, 3, 4 or 5 years

Last edited:

- 10,563

That is kind of the point. Perhaps I see it incorrectly though.

New money locks in new Bonds at currently higher rates (regardless of the duration).

The carrier must set aside new reserves based on new money.

Old money is locked in at that old rate.

On Bonds are currently trading at a discount....

When enough old money comes off the books, they have to sell some of those old Reserves/Bonds... at a discount.

That is why I mentioned annually renewable vs. locked-in for another Term.

If locked-in, it seems they could afford the keep the rate higher.

If annually renewed, the client could jump ship and force them to sell those Reserves/Bonds at a discount.

Im sure its much more complicated than that in reality. But that is how I've always viewed it based on my limited knowledge of how insurers place Reserves.

New money locks in new Bonds at currently higher rates (regardless of the duration).

The carrier must set aside new reserves based on new money.

Old money is locked in at that old rate.

On Bonds are currently trading at a discount....

When enough old money comes off the books, they have to sell some of those old Reserves/Bonds... at a discount.

That is why I mentioned annually renewable vs. locked-in for another Term.

If locked-in, it seems they could afford the keep the rate higher.

If annually renewed, the client could jump ship and force them to sell those Reserves/Bonds at a discount.

Im sure its much more complicated than that in reality. But that is how I've always viewed it based on my limited knowledge of how insurers place Reserves.

Last edited:

- Thread starter

- #6

Update, I was also told I could do an internal transfer at Oxford for any MYGA excepting a 4 year term(my current policy term), for the rates in effect now.

This would seem to save Oxford from paying any commission should I pick this option.

I'm doing a 1035 because I don't like the way they do business. If all annuity companies do this, I have a lot of 1035's in my future.

This would seem to save Oxford from paying any commission should I pick this option.

I'm doing a 1035 because I don't like the way they do business. If all annuity companies do this, I have a lot of 1035's in my future.

Some do, some don't.Update, I was also told I could do an internal transfer at Oxford for any MYGA excepting a 4 year term(my current policy term), for the rates in effect now.

This would seem to save Oxford from paying any commission should I pick this option.

I'm doing a 1035 because I don't like the way they do business. If all annuity companies do this, I have a lot of 1035's in my future.

- 4,776

Yeah, gets confusing on my brain.That is kind of the point. Perhaps I see it incorrectly though.

New money locks in new Bonds at currently higher rates (regardless of the duration).

The carrier must set aside new reserves based on new money.

Old money is locked in at that old rate.

On Bonds are currently trading at a discount....

When enough old money comes off the books, they have to sell some off those old Reserves/Bonds... at a discount.

That is why I mentioned annually renewable vs. locked-in for another Term.

If locked-in, it seems they could afford the keep the rate higher.

If annually renewed, the client could jump ship and force them to sell those Reserves/Bonds at a discount.

Im sure its much more complicated than that in reality. But that is how I've always viewed it based on my limited knowledge of how insurers place Reserves.

It just seems to me that some carriers must be experiencing net losses in their MYGA holdings if both their new rate & renewal rates are not competitive for independent agents to write their new stuff and not replace the renewal stuff they have on the books. Would seem less expensive to keep some stuff on the books. I am not talking of the really old contracts from 20-40 years ago with lifetime guarantees of 3, 4, 4.5%

Be careful with 1035 exchanges. Some carriers fail to report cost basis to the next carrier & if not reported, new carrier enters 0 for cost basis, meaning future withdrawals or death would report 100% as taxable gain.Update, I was also told I could do an internal transfer at Oxford for any MYGA excepting a 4 year term(my current policy term), for the rates in effect now.

This would seem to save Oxford from paying any commission should I pick this option.

I'm doing a 1035 because I don't like the way they do business. If all annuity companies do this, I have a lot of 1035's in my future.

Have seen it a few times over the years

- 10,563

Yeah, gets confusing on my brain.

It just seems to me that some carriers must be experiencing net losses in their MYGA holdings if both their new rate & renewal rates are not competitive for independent agents to write their new stuff and not replace the renewal stuff they have on the books. Would seem less expensive to keep some stuff on the books. I am not talking of the really old contracts from 20-40 years ago with lifetime guarantees of 3, 4, 4.5%

I absolutely agree about the "f*ck off rates". Thats what I call them.

They dont want any new business, but they are not ready to pull the product off market. It absolutely happens.

Similar threads

- Replies

- 2

- Views

- 921

- Replies

- 5

- Views

- 2K

Latest posts

-

-

Non-Compete - FTC (Federal Trade Commission) Final Rule

- Latest: Markthebroker

-

-