InsuranceGuy29

Guru

- 848

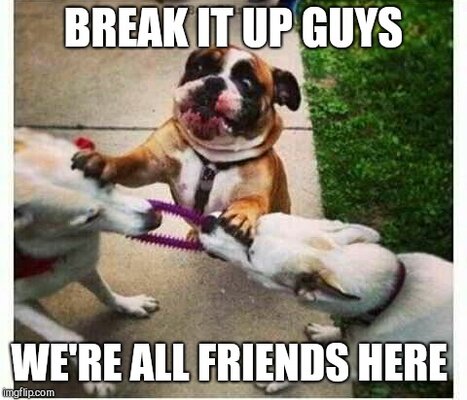

In the end shits hitting the fan . Maximum commissions are $610 but CO's can give less . What the Humana articles today sound like there not pricing products to be unprofitable and if they lose business so be it . They days of buying business are over . But United never bought business and stayed disciplined.

Cutting commission would be suicide for carriers, because brokers will just stop completely writing them. Any even remotely decent CEO understands that. Much easier ways to save money that don't affect the brokers. The brokers are your lifeblood.

A few years ago, Cigna introduced a few $0 commission PDP plans. What they found is, not only did brokers not write those $0 commission plans, brokers also completely stopped writing ANY Cigna plans. The commission later magically returned after the findings.

Brokers control your entire business, and in the overall scheme of things, they are an immensely cheap benefit to have. It's not even a remotely good idea to screw with them.

United Healthcare understands this well. Even outside the Medicare realm, they take care of the brokers well, monetarily. As a result, who is #1 in the insurance business? United Healthcare. The benefits all being very similar, brokers will write the company that takes care of them best over the other companies.

Rule #1 for any insurance CEO......Do NOT screw with the brokers' pay, because they will make YOU pay.

Last edited: