- 4,575

Fixed Annuity with a reputably company looking to get paid and do the rt thing 10yr surrender is not an issue for the client.

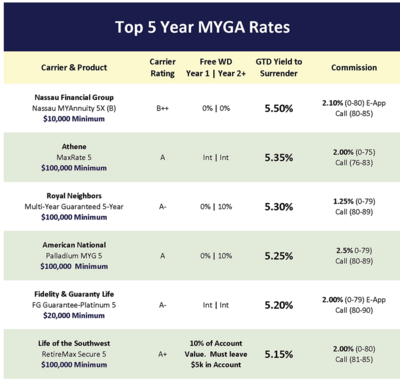

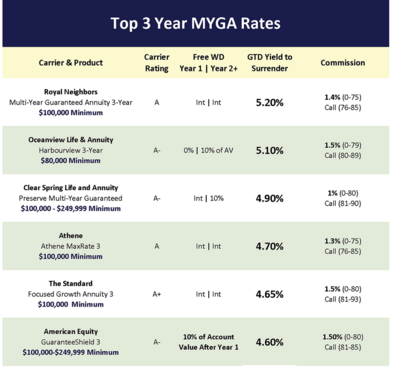

For the most part, fixed Annuities with 10 year surrender don't exist anymore. There are very few flexible premium annuities in the marketplace anymore. Almost all fixed annuities are now single premium MYGA (Multi Year Guaranteed Annuity) & they act similar to a CD. Client picks a 3, 5 7 or 10 year rate lock (,most all today are 3 & 5 year because of inverted yield curve)

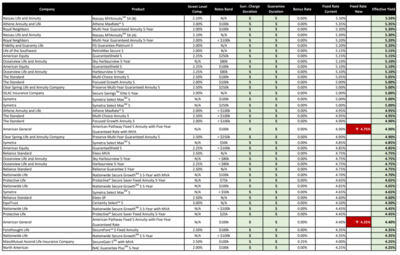

3 year MYGA with most carriers are 1-2% commission & 5 year are 2-3%...the higher commission rate carrier tend to be B rated carriers & they tend to have slightly higher interest rate to client as they are having to lure the cash to them with better rates than the better A rated carriers.

Connect with a good IMO & they will have several dozen carriers. The weekly rate sheets tend to have carrier interest rate & commission on them along with surrender schedule & should also state if they allow any free withdrawals or not, if they have return of premium minimum at surrender or not or if they have an Market Value Adjustment that can hurt client if they surrender early over & above the surrender charge

Here is a website too:. [EXTERNAL LINK] - Today's Best Multi-Year Guaranteed Annuities (MYGAs) — ImmediateAnnuities.com