Hello Everyone, I am writing here to respectfully ask for guidances or help with insurance company (AAA) that i have been dealing with last two months or so.

i was hit by reckless driver stopped at the light from the side. The other party insurance accepted the full liability ( glad i had a dashcam). It resulted my car to be declared total loss. It is 2010 FJ cruiser trail teams edition 1/1500

a long story short, I have some questions

1. I have over $4000 factory accessories installed after i got the car and they are all less than 1year old. I have receipts for most of them. Am I entitled for accessories installed after i got the car? Remember this is with at faults party insurance

2. Loss of use can be claimed through the period of negotiation until the settlement correct? They used the wrong comparison ( base FJ) in the two very first CCC reports)

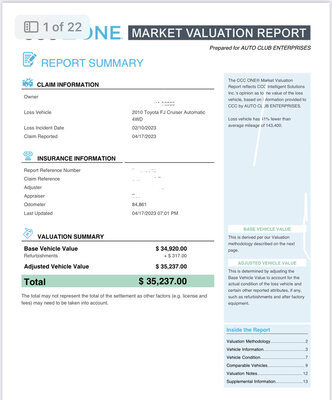

if you can help me with these questions, ill be greatly appreciated. I am trying to get my claims settled. I have hired 3rd party professional appraiser and submitted the report but the insurance still going by CCC and says it is the right value. I have offered referee appraiser but refused

i was hit by reckless driver stopped at the light from the side. The other party insurance accepted the full liability ( glad i had a dashcam). It resulted my car to be declared total loss. It is 2010 FJ cruiser trail teams edition 1/1500

a long story short, I have some questions

1. I have over $4000 factory accessories installed after i got the car and they are all less than 1year old. I have receipts for most of them. Am I entitled for accessories installed after i got the car? Remember this is with at faults party insurance

2. Loss of use can be claimed through the period of negotiation until the settlement correct? They used the wrong comparison ( base FJ) in the two very first CCC reports)

if you can help me with these questions, ill be greatly appreciated. I am trying to get my claims settled. I have hired 3rd party professional appraiser and submitted the report but the insurance still going by CCC and says it is the right value. I have offered referee appraiser but refused