RunnerDude

Super Genius

- 181

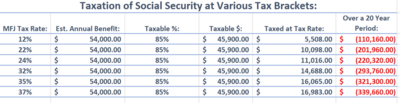

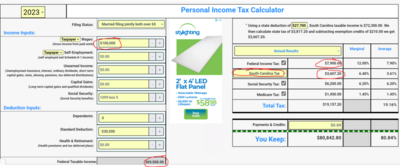

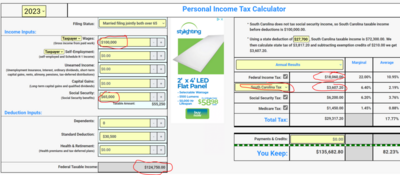

I am working with a healthy 66 -year- old male (married) who has the following:

1. Social Security = $5,400 per month (joint)- starts this year (does not want to wait to age 70)

2. FIA with Allianz ABC (increasing income). $430,000 invested this year.

3. Still works making about $100,000 per year. No retirement date in sight.

4. Yearly expenses add up to about $90,000.

5. No long-term care or life insurance for either spouse. Wife is likely not insurable.

The problem is that all income is taxable. He has not yet started a ROTH IRA to mitigate tax liability. The question is: Where should he invest the extra cash he will not need. The most he and his wife can put into a Roth IRA is $15,000 per year. The only other vehicle available is the IUL (he does not want to invest in stock, land or crypto). The only other thing would be CD's or money market accounts. I know it would take 7 to 10 years for a IUL to begin seeing a profit, but it may make sense. Input in appreciated.

1. Social Security = $5,400 per month (joint)- starts this year (does not want to wait to age 70)

2. FIA with Allianz ABC (increasing income). $430,000 invested this year.

3. Still works making about $100,000 per year. No retirement date in sight.

4. Yearly expenses add up to about $90,000.

5. No long-term care or life insurance for either spouse. Wife is likely not insurable.

The problem is that all income is taxable. He has not yet started a ROTH IRA to mitigate tax liability. The question is: Where should he invest the extra cash he will not need. The most he and his wife can put into a Roth IRA is $15,000 per year. The only other vehicle available is the IUL (he does not want to invest in stock, land or crypto). The only other thing would be CD's or money market accounts. I know it would take 7 to 10 years for a IUL to begin seeing a profit, but it may make sense. Input in appreciated.