The couple I have used were for people that height challenged in relation to weight.. No problems..Have you used the Accendo product? Have you gotten mostly instant approvals? Any declines that were a surpise?

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

What Are The Top 10 Easiest & Fastest Final Expense Insurance Products To Write?...

- Thread starter FETalk

- Start date

- Thread starter

- #12

FETalk

Super Genius

- 140

Is always a result of mib codes

Is it just me, or has anybody else been running into a lot of MIB cases lately?

- Thread starter

- #13

FETalk

Super Genius

- 140

SNL (paper app) Does not require a phone call/

Accendo (Paper or eapp) Does not require a phone call.

Great Western (eapp) Does not require a phone call

You might get the impression that I hate doing PHIs.. Seems to be a waste of time.. And, there are a lot of areas that I work that you cannot get a signal.

I think PHI's are good, only if you can get an instant approval/decline decision at the end of the call, otherwise, I agree, they're a complete waste of time.

- Thread starter

- #14

FETalk

Super Genius

- 140

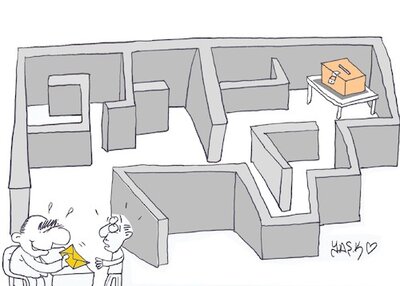

One of the reasons why I posed the question originally, is because it seems like a lot of insurance companies make their FE application process unnecessarily long and/or difficult for no good reason whatsoever.

In my opinion, there's no reason why, in this day and age, any FE insurance company should:

1) Not have an electronic and/or telephonic app.

2) Have an application that takes longer than 5-10 minutes to complete.

3) Have an underwriting process that takes longer 24 hours for a decision (for "a clean app").

Source: difficult process By yasar kemal turan | Politics Cartoon | TOONPOOL

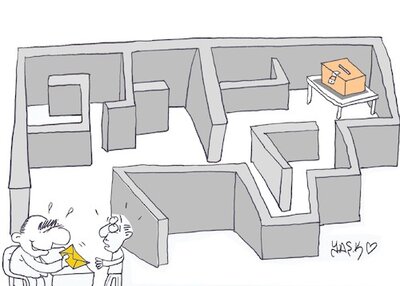

In my opinion, there's no reason why, in this day and age, any FE insurance company should:

1) Not have an electronic and/or telephonic app.

2) Have an application that takes longer than 5-10 minutes to complete.

3) Have an underwriting process that takes longer 24 hours for a decision (for "a clean app").

Source: difficult process By yasar kemal turan | Politics Cartoon | TOONPOOL

Last edited:

- 4,892

One of the reasons why I posed the question originally, is because it seems like a lot of insurance companies make their FE application process unnecessarily long and/or difficult for no good reason whatsoever.

In my opinion, there's no good reason why, in this day and age, any FE insurance company should:

1) Not have an electronic and/or telephonic app.

2) Have application that takes longer than 5-10 minutes to complete.

3) Have an underwriting process that takes longer 24 hours for a decision (for "a clean app").

Sr Life meets the requirements of #1, 2, and 3. There may be other carriers also.

PhxSunsFan

Guru

- 602

an the winner is,,,,,,,,, Sr. Life,,

- 325

I'll admit to being 100% in the dark on Sr Life. Don't see them on FEX Toolkit to even see how they compare.an the winner is,,,,,,,,, Sr. Life,,

Fill me in.

Higher than average rates for the plan most write..I'll admit to being 100% in the dark on Sr Life. Don't see them on FEX Toolkit to even see how they compare.

Fill me in.

- 4,892

Higher than average rates for the plan most write..

But when the policy is bundled with the $4 monthly membership into Legacy the insured will get:

_Casket, vault, and monument locked in for $2950 for the life of the insured. This same merchandise can run over $7000 at the funeral home when Ms. Jones has a policy with a different carrier. That's a savings of approx. $4k right there.

_Discounts on hearing aids, diabetic socks, and diabetic shoes.

_Free hearing exam once per year

_24 hour telemedicine 7 days/week

_Legacy will negotiate the price of the funeral/cremation on behalf of the family for additional savings

_Up to 4 family members can be added, completely free, to this $4 monthly membership. This means these 4 family members can get the exact same savings as the insured completely free. So if another carrier was $50 a month cheaper this other carrier can only save Ms. Jones the $50 per month in her premium. Legacy saves approx. $4000 on funeral expenses immediately on the 1st day the policy is issued, no health nor age restrictions, on Ms. Jones as well up to 4 other family members each saving approx. $4000 on their funerals too. This, of course, is a much, much better savings for Ms. Jones than $50 per month the other carrier would provide.

They are not perfect, but they are good enough for me to have been writing business with this group since 1999. I could put a lot more bullet points of things they have that help their agents that other carriers don't have. Love the fact that leads can be financed and that charge backs come on the back end not the front end (advances). Simple one page app, no MIB's, no APS's, no phone interviews while at the prospects house, only an RX script check.

As far as higher than average rates it depends on the health condition being addressed. For ex they don't care if the proposed insured was taking insulin before the age of 40.

They've been growing rapidly the last few years so they must be doing something right; both for the agent and the carrier. Their TV commercials generate the best FE leads in America. And yes, I'm a big fan of Sr Life. Seems like most other carriers that are mentioned on this forum are mentioned as being horrible to do business with: no notices of missed drafts provided to the agent, being on hold for 45 min or longer on the phone in the prospect's house, no lead program for their agents, etc.

If anyone has any questions about their opportunity please feel free to call me at 252-292-3350

Greg that's why an individual agent finds the 4 or 5 carriers . For instance I can write someone that had cancer non active 1 week ago , heart attack 1 day ago , oxygen as long as not 24/7 .It has 50% 12 month and a day benefit for 1/2 your GI price and make 40% more commission with no mib or rx check . 30-40% of SL's policy's go GI I can get level and make 40% more commission .I agree many people need an organization and group to thrive .But real self starters don't .

Similar threads

- Replies

- 22

- Views

- 771

- Replies

- 48

- Views

- 6K

- Replies

- 83

- Views

- 11K

Latest posts

-

-

CrossFit work out from detached garage on property

- Latest: Markthebroker

-

-