- 2,290

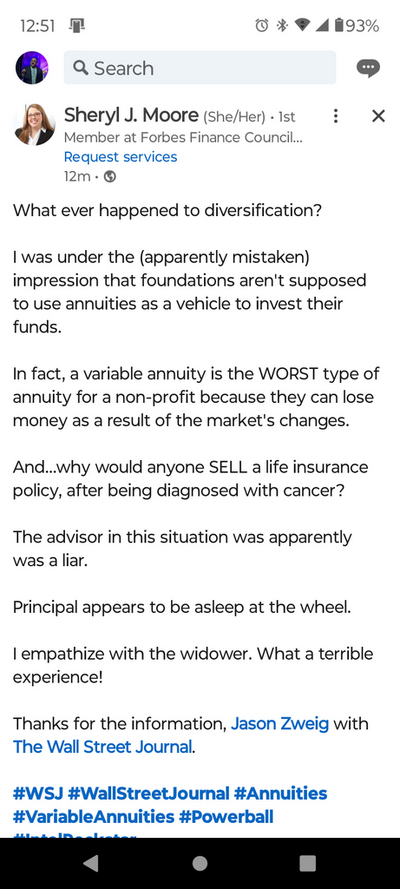

Perhaps I missed a post, but I am a bit surprised that this article has yet to be posted. THIS is why Annuities have a bad rap, IMO.

By

Jason Zweig

Follow

July 12, 2024 11:08 am ET

In spring 2008, Paul Rosenau, a construction supervisor and heavy-equipment operator in Waseca, Minn., bought a Powerball ticket—and hit a $59.6 million after-tax jackpot.

Rosenau, a devout Lutheran and the son of a pastor, recalls with a tremor in his voice how he and his wife, Sue Rosenau, felt when they woke up the next morning.

They realized their granddaughter Makayla had died exactly five years earlier. She had Krabbe disease—a rare neurodegenerative illness that strikes infants and usually kills them in less than four years. Makayla died at the age of two.

“We were very sure [the Powerball jackpot] was divine intervention,” Rosenau recalls, “and we were very sure what we were supposed to do with it.”

What they hadn’t counted on, though, was that human intervention can be destructive. What happened next is a heartbreaking tale that shows how powerfully fees and commissions can pervert financial advisers’ judgment and crush their clients’ wealth.

It’s also why I think investors should welcome regulations that require advisers, brokers and insurance agents to act in their customers’ best interests.

The Rosenaus promptly used $26.4 million of their winnings to fund a nonprofit, now known as the Rosenau Family Research Foundation. Its mission is to seek treatments for, and support the families of, children with Krabbe disease.

Having almost no investment experience themselves, the couple hired John Priebe, a local financial adviser and insurance agent, to manage the family’s and the foundation’s money.

Priebe worked for Principal Securities, the brokerage and investment-advisory arm of Principal Financial Group PFG 1.25%increase; green up pointing triangle, the Des Moines-based retirement, asset-management and insurance giant. He claimed to be putting his new clients’ best interests ahead of his own, but that’s not what the evidence suggests.

Last month, an arbitration panel run by the Financial Industry Regulatory Authority instructed Principal Securities to pay $7.3 million in compensatory damages to the Rosenau foundation.

Principal Securities has until July 15 to bring a motion in court to vacate the award, according to Donald McNeil of Heley, Duncan & Melander in Minneapolis, an attorney for the Rosenaus.

During the arbitration proceeding, the firm denied the allegations, which included the selection of unsuitable investments, failure to supervise Priebe and failure to disclose fees and expenses. Principal declined my requests for comment.

Only weeks after their Powerball score, the Rosenaus were flown on a private plane with Priebe to Principal’s headquarters, where they met with senior management and “everybody but the janitor,” recalls Rosenau. The executives, he says, assured them that Principal had “the expertise” to keep the money safe and make it grow. (In legal filings, Principal subsidiaries have denied the details of the meeting.)

According to evidence submitted at the arbitration hearings, Priebe started by buying $18.9 million of variable annuities for the foundation, earning an estimated $1.2 million in commissions.

Those insurance assets generally have all the market risks of mutual funds—at vastly higher costs. Mutual funds, exchange-traded funds and other types of investments typically don’t carry commissions and charge annual fees that can be 0.1% or less.

Instead, the variable annuities picked by Priebe charged the foundation annual fees of up to 2% or more and carried commissions that could exceed 6%.

By the end of 2011, Priebe had allocated almost 93% of the nonprofit’s total assets to variable annuities from Principal and several other issuers.

In April 2017, Rosenau emailed Priebe, asking him for “a statement disclosing all fees, commissions, charges, transfer fees, etc. of any kind that will be charged for the purchase of any investment device you are planning on using.” Priebe emailed back, “There is no fee’s on this Product” [sic].

Meanwhile, Priebe had been repeatedly selling some of the variable annuities and buying others, earning fresh commissions along the way.

All told, he had the foundation buy more than $47 million in variable annuities, according to evidence at the arbitration hearing, generating an estimated $3.3 million in commissions.

In theory, those products provide some tax and other benefits. But a foundation isn’t taxable, and it requires steady growth of its assets and ready liquidity to ensure it can meet its annual spending needs. So the limited advantages of variable annuities aren’t useful to a foundation, while their high costs and low liquidity are detrimental.

By year-end 2011, Priebe had sunk $28.3 million of the foundation’s assets into variable annuities. Six years later, that pool had shrunk to $26.3 million—even though the stock market had more than doubled over the period.

I estimate the foundation could have earned $12 million to $25 million more between 2011 and 2017, when it finally pulled its money away from Priebe and Principal, if it had invested instead in a simple balanced index fund with 60% in stocks and 40% in bonds.

“It’s very important, regardless of the size of the nonprofit, to ensure that their strategy is in a position to perpetuate the mission of the foundation,” says Matthew Wright, former chief investment officer of Vanderbilt University and the president of Disciplina Group, a firm in Nashville, Tenn., specializing in asset management for nonprofits.

“I’ve never heard of a nonprofit entity purchasing variable annuities as part of an investment strategy,” he says.

In 2015, Sue Rosenau learned she had ovarian and uterine cancer.

In early 2017, according to a complaint in a separate civil lawsuit filed by the Rosenau foundation in a Minnesota district court, Priebe recommended that the foundation sell a $3 million insurance policy on her life at a discounted price of $1.46 million.

The complaint claims Priebe and Principal didn’t disclose to the family or the foundation that a doctor who consulted on the sale had estimated that Sue Rosenau would die within two years.

She died in July 2018.

Had the foundation held on to the insurance policy instead of selling, it would have collected the full $3 million.

Principal’s affiliates, in their court filings, deny any wrongdoing.

In October 2019, Principal Securities fired Priebe “due to concerns with his business practices and the lack of documentation supporting them,” according to a regulatory filing.

In January 2020, Priebe died by suicide. I was unable to reach his widow for comment.

Although Rosenau wishes the foundation had never invested in the annuities that dragged down its returns, he’s proud that it has been able to foster an extensive program of research into Krabbe disease.

Still, even after prevailing in the arbitration hearing, he marvels at how fees and commissions can distort the behavior of people who sell investments.

“Why would you take money away from poor dang kids that don’t even have a year or two to live?” he says, his voice rising. “What the heck’s wrong with you? How much is enough?”

Write to Jason Zweig at [email protected]

Full Article here

How high fees and low returns hurt a nonprofit that trusted a local financial adviser

By

Jason Zweig

Follow

July 12, 2024 11:08 am ET

In spring 2008, Paul Rosenau, a construction supervisor and heavy-equipment operator in Waseca, Minn., bought a Powerball ticket—and hit a $59.6 million after-tax jackpot.

Rosenau, a devout Lutheran and the son of a pastor, recalls with a tremor in his voice how he and his wife, Sue Rosenau, felt when they woke up the next morning.

They realized their granddaughter Makayla had died exactly five years earlier. She had Krabbe disease—a rare neurodegenerative illness that strikes infants and usually kills them in less than four years. Makayla died at the age of two.

“We were very sure [the Powerball jackpot] was divine intervention,” Rosenau recalls, “and we were very sure what we were supposed to do with it.”

What they hadn’t counted on, though, was that human intervention can be destructive. What happened next is a heartbreaking tale that shows how powerfully fees and commissions can pervert financial advisers’ judgment and crush their clients’ wealth.

It’s also why I think investors should welcome regulations that require advisers, brokers and insurance agents to act in their customers’ best interests.

The Rosenaus promptly used $26.4 million of their winnings to fund a nonprofit, now known as the Rosenau Family Research Foundation. Its mission is to seek treatments for, and support the families of, children with Krabbe disease.

Having almost no investment experience themselves, the couple hired John Priebe, a local financial adviser and insurance agent, to manage the family’s and the foundation’s money.

Priebe worked for Principal Securities, the brokerage and investment-advisory arm of Principal Financial Group PFG 1.25%increase; green up pointing triangle, the Des Moines-based retirement, asset-management and insurance giant. He claimed to be putting his new clients’ best interests ahead of his own, but that’s not what the evidence suggests.

Last month, an arbitration panel run by the Financial Industry Regulatory Authority instructed Principal Securities to pay $7.3 million in compensatory damages to the Rosenau foundation.

Principal Securities has until July 15 to bring a motion in court to vacate the award, according to Donald McNeil of Heley, Duncan & Melander in Minneapolis, an attorney for the Rosenaus.

During the arbitration proceeding, the firm denied the allegations, which included the selection of unsuitable investments, failure to supervise Priebe and failure to disclose fees and expenses. Principal declined my requests for comment.

Only weeks after their Powerball score, the Rosenaus were flown on a private plane with Priebe to Principal’s headquarters, where they met with senior management and “everybody but the janitor,” recalls Rosenau. The executives, he says, assured them that Principal had “the expertise” to keep the money safe and make it grow. (In legal filings, Principal subsidiaries have denied the details of the meeting.)

According to evidence submitted at the arbitration hearings, Priebe started by buying $18.9 million of variable annuities for the foundation, earning an estimated $1.2 million in commissions.

Those insurance assets generally have all the market risks of mutual funds—at vastly higher costs. Mutual funds, exchange-traded funds and other types of investments typically don’t carry commissions and charge annual fees that can be 0.1% or less.

Instead, the variable annuities picked by Priebe charged the foundation annual fees of up to 2% or more and carried commissions that could exceed 6%.

By the end of 2011, Priebe had allocated almost 93% of the nonprofit’s total assets to variable annuities from Principal and several other issuers.

In April 2017, Rosenau emailed Priebe, asking him for “a statement disclosing all fees, commissions, charges, transfer fees, etc. of any kind that will be charged for the purchase of any investment device you are planning on using.” Priebe emailed back, “There is no fee’s on this Product” [sic].

Meanwhile, Priebe had been repeatedly selling some of the variable annuities and buying others, earning fresh commissions along the way.

All told, he had the foundation buy more than $47 million in variable annuities, according to evidence at the arbitration hearing, generating an estimated $3.3 million in commissions.

In theory, those products provide some tax and other benefits. But a foundation isn’t taxable, and it requires steady growth of its assets and ready liquidity to ensure it can meet its annual spending needs. So the limited advantages of variable annuities aren’t useful to a foundation, while their high costs and low liquidity are detrimental.

By year-end 2011, Priebe had sunk $28.3 million of the foundation’s assets into variable annuities. Six years later, that pool had shrunk to $26.3 million—even though the stock market had more than doubled over the period.

I estimate the foundation could have earned $12 million to $25 million more between 2011 and 2017, when it finally pulled its money away from Priebe and Principal, if it had invested instead in a simple balanced index fund with 60% in stocks and 40% in bonds.

“It’s very important, regardless of the size of the nonprofit, to ensure that their strategy is in a position to perpetuate the mission of the foundation,” says Matthew Wright, former chief investment officer of Vanderbilt University and the president of Disciplina Group, a firm in Nashville, Tenn., specializing in asset management for nonprofits.

“I’ve never heard of a nonprofit entity purchasing variable annuities as part of an investment strategy,” he says.

In 2015, Sue Rosenau learned she had ovarian and uterine cancer.

In early 2017, according to a complaint in a separate civil lawsuit filed by the Rosenau foundation in a Minnesota district court, Priebe recommended that the foundation sell a $3 million insurance policy on her life at a discounted price of $1.46 million.

The complaint claims Priebe and Principal didn’t disclose to the family or the foundation that a doctor who consulted on the sale had estimated that Sue Rosenau would die within two years.

She died in July 2018.

Had the foundation held on to the insurance policy instead of selling, it would have collected the full $3 million.

Principal’s affiliates, in their court filings, deny any wrongdoing.

In October 2019, Principal Securities fired Priebe “due to concerns with his business practices and the lack of documentation supporting them,” according to a regulatory filing.

In January 2020, Priebe died by suicide. I was unable to reach his widow for comment.

Although Rosenau wishes the foundation had never invested in the annuities that dragged down its returns, he’s proud that it has been able to foster an extensive program of research into Krabbe disease.

Still, even after prevailing in the arbitration hearing, he marvels at how fees and commissions can distort the behavior of people who sell investments.

“Why would you take money away from poor dang kids that don’t even have a year or two to live?” he says, his voice rising. “What the heck’s wrong with you? How much is enough?”

Write to Jason Zweig at [email protected]

The Intelligent Investor

More from columnist Jason ZweigFull Article here