PrivClientSG

Guru

- 325

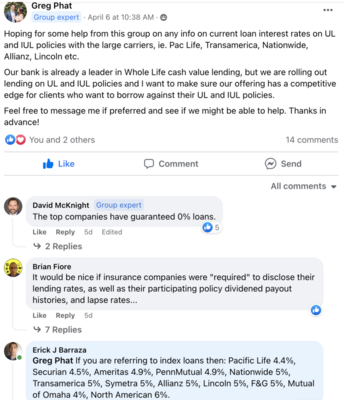

Hope everyone is having a great day. What's the best cash value line of credit (for whole life policies) program you are aware of? While "best" is a relative term, let me clarify -- what's the lowest rate you are aware of?

When I look at the various banks and their programs, I look at these items:

1) Interest rate (usually variable, and tied to WSJ Prime, so it's usually WSJ Prime minus ____ (fill in the blank)

2) Do they offer a fixed interest rate option?

3) What % of the cash value will the bank loan you via the line of credit (usually between 92% and 95%)?

4) Term of the line of credit (usually between 2 years and 5 years, before it renews)?

5) Payment options -- interest only, interest and principal?

6) Do they consider this non-recourse so that the line of credit does not appear on the borrower's credit report?

It should be an interesting exercise next time around for clients as the interest rate has gone up from 2.75% and 3% to now in the high 5's and low to mid 6's. Yes, and as many of you are already thinking -- compare that to the borrow rates on policy loans. Those could be 8, down to 6; maybe 7 down to 5; or even 6 down to 4, depending on the age of the insured, age of the policy, etc. Yes, direct recognition vs. non-direct will absolutely play into this too.

All that aside -- what's the best, most favorable program out there that you are aware of? Thank you in advance!

When I look at the various banks and their programs, I look at these items:

1) Interest rate (usually variable, and tied to WSJ Prime, so it's usually WSJ Prime minus ____ (fill in the blank)

2) Do they offer a fixed interest rate option?

3) What % of the cash value will the bank loan you via the line of credit (usually between 92% and 95%)?

4) Term of the line of credit (usually between 2 years and 5 years, before it renews)?

5) Payment options -- interest only, interest and principal?

6) Do they consider this non-recourse so that the line of credit does not appear on the borrower's credit report?

It should be an interesting exercise next time around for clients as the interest rate has gone up from 2.75% and 3% to now in the high 5's and low to mid 6's. Yes, and as many of you are already thinking -- compare that to the borrow rates on policy loans. Those could be 8, down to 6; maybe 7 down to 5; or even 6 down to 4, depending on the age of the insured, age of the policy, etc. Yes, direct recognition vs. non-direct will absolutely play into this too.

All that aside -- what's the best, most favorable program out there that you are aware of? Thank you in advance!