Some of the letters I've received refer to "flexible annuity/flexible annuity rider". The statements I have received say"plan code 000022-Roth". I am 56 years old so I am concerned if this distribution is treated as a non qualified annuity where I'd have to pay a penalty and tax on the gains and interest is paid out first. If it is a Roth then no tax or penalty because the distribution rules for Roth say principal paid out before interest and you can withdraw principal at any age without penalty. I guess I am confused as to what I have and confused about an annuity disguised as a Roth.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Colorado Bankers (CB Life)...

- Thread starter FETalk

- Start date

- 5,293

sure sounds like you have a Roth.Some of the letters I've received refer to "flexible annuity/flexible annuity rider". The statements I have received say"plan code 000022-Roth". I am 56 years old so I am concerned if this distribution is treated as a non qualified annuity where I'd have to pay a penalty and tax on the gains and interest is paid out first. If it is a Roth then no tax or penalty because the distribution rules for Roth say principal paid out before interest and you can withdraw principal at any age without penalty. I guess I am confused as to what I have and confused about an annuity disguised as a Roth.

Do you have your original policy packet? It should say in the front what type it is & also, your original application copy should be in the back of the policy jacket where you should see your original application.

Lastly, do you receive annually or at least in the year it was started an IRS form 5498? That is a form the IRS uses for somewhat tracking deposits or valuations of qualified plans. https://www.irs.gov/pub/irs-pdf/f5498.pdf

Honestly I have no idea where the policy information is. I kept it at work in my files and changed jobs once and retired since I started this cursed investment. I guess I was hoping someone would recognize that code "000022-Roth" and know if is treated as a Roth IRA or a non qualified annuity as far as withdrawal order, taxes, and penalties.

- 5,293

Honestly I have no idea where the policy information is. I kept it at work in my files and changed jobs once and retired since I started this cursed investment. I guess I was hoping someone would recognize that code "000022-Roth" and know if is treated as a Roth IRA or a non qualified annuity as far as withdrawal order, taxes, and penalties.

I doubt you will find agents on here that wrote CBL annuities, most were sold through banks if I remember correctly.

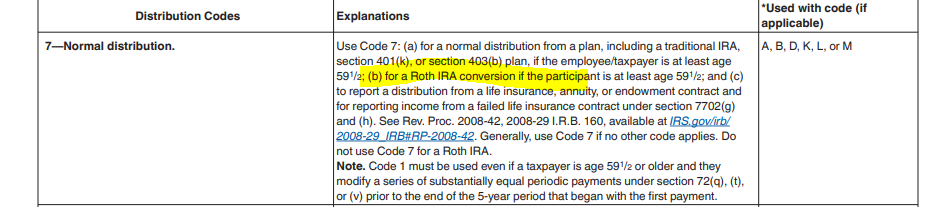

Have you taken money out of this account at all in the past? or did you take the 25% out last fall? If so, your 1099R that they sent you should have the tax code on the 1099 R. I believe the Distribution code in BOX 7 will show as 7b for a ROTH, but 7a for regular IRA or NQ Annuity

May 6 was the last I read.

If you want to throw up read this link

finance.yahoo.com

finance.yahoo.com

If you want to throw up read this link

Greg Lindberg’s Strikingly Candid Interview With Jay Feldman Goes Viral

Greg Lindberg and Dr. Jay Feldman on the Mentors Collective Podcast Greg Lindberg and Dr. Jay Feldman on the Mentors Collective Podcast TAMPA, Fla., April 29, 2024 (GLOBE NEWSWIRE) -- Entrepreneur, philanthropist, and author of 633 Days Inside, Greg Lindberg recently took center stage on the...

- 11,036

Wow. So another danger of SGA protection emerges.

Participating Carriers dont have to cover losses if there is obvious fraud?

Seems like a lot of loopholes and roadblocks in this system.

Participating Carriers dont have to cover losses if there is obvious fraud?

Seems like a lot of loopholes and roadblocks in this system.

- 5,293

interesting--where did you see thatWow. So another danger of SGA protection emerges.

Participating Carriers dont have to cover losses if there is obvious fraud?

Seems like a lot of loopholes and roadblocks in this system.

lindberg retrial no trial on 5/6 court closed, should start tomorrow

lindberg has 8 lawyers listed! US Government only 4 lawyers

lindberg has 8 lawyers listed! US Government only 4 lawyers

| 05/07/2024 | |

| 09:30 AM | |

| 5:19-cr-00022-MOC-DCK-1 USA v. Lindberg et al | |

| Benjamin Bain-Creed and Dana Owen Washington and Lawrence Jason Cameron and William Gullotta representing USA (Plaintiff) Brandon N. McCarthy and Elizabeth Freeman Greene and James F. Wyatt and Jeffrey C Grady and Paul J. Johnson and Rachel M. Riley and Robert Adams Blake, Jr and Robert T. Smith representing Greg E. Lindberg (Defendant) | |

| Hearing in CHARLOTTE Courtroom #8 *** Jury Trial *** |

Similar threads

- Replies

- 59

- Views

- 6K

- Replies

- 68

- Views

- 8K

- Replies

- 22

- Views

- 911

- Replies

- 6

- Views

- 933

- Replies

- 7

- Views

- 848