Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Colorado Bankers (CB Life)...

- Thread starter FETalk

- Start date

- 5,262

Definitely talk to CPA to amend or correct it depending how your 1099 looks next JanuaryThis 2.22% rate is a total rip off. In 2023 the 25% mandatory withdrawal cause a taxable event based on the contract rate, mine was 3.6%. Now they are going to reduce the interest rate for the 4 years before the rehabilitation date June 27, 2019, to 2.22% and after the rehabilitation date to 1.08%.

Even with all the time that has elapsed the interest actually earned on the policy will be less then the amount of interest I've already paid taxes on. It seems like some kind of adjustment on the 1099's needs to be made.

- 5,262

This sounds alot like my assumptions way earlier in the threads. Some people were thinking 25% would be in addition to the state guaranty & that they would be owed to current locked in interest rates. But the insurance carriers coming to the rescue of the guaranty association only get assessed to fund the guaranteed values of the failed carriers contracts that the failed carriers assets were insufficient to cover.Did some figuring, and its even worse that I thought. Put in 100K on 4/3/18. At rates of 2.22% to 6/27/2019, then 1.08% til my surrender date of 1/14/2025, adjusting for the 2021 withdrawal, 6 interest only payments, and the 25% mandatory payment in 2023, my total new interest earned is 8512.

My 2023 1099 on which I paid tax box 2a is for 18787.00. I think this will be a theft loss so only deductible on Schedule A, but not tax advice. Anybody have any ideas on this?

I still can't figure out how much they will send me whenever they get around to it, maybe this year?

My surrender value on the web site is 87341, but when I figure the new rates of interest amounts I come up with 74924, so it looks like a loss of 12417 of interest.

Considering these annuities were sold by alot of corner office financial reps in a bank, I am still shocked there has been no litigation against those banks that chose to sell a lower rated carrier that was offering higher interest rates & higher commissions to the banks. When a business is offering something better & paying commissions higher, it usually indicates a cash flow problem & they are trying to attract new business......but long term it can end up poorly

Last edited:

- 5,262

Wow. I wonder who votes for the SGA. If those insurance carriers are stock owned companies, voting to pay more than the law provides coverage could be a problem with the stockholders. I am assuming the good insurance carriers didn't raise their hand to pay more than required to bail out a corrupt & failed carrier like CBL.Great news!!

We got our check yesterday!

We have been made whole....finally....

This nightmare is OVER!!

The whole 400 initial investment plus all the interest... for 5 years...

at 3.6%....

Last year we had to pay taxes on all that interest....which was another mini nightmare on its own....but that's behind us now!

Thank God the Massachusetts Guaranty Association voted to cover excess policy holders....

My last parting words to anyone on this website is:

CALL YOUR STATE GUARANTY ASSOCIATION AND DON'T BOTHER CALLING ANYONE ELSE!!

Annuities never again....

Good bye!

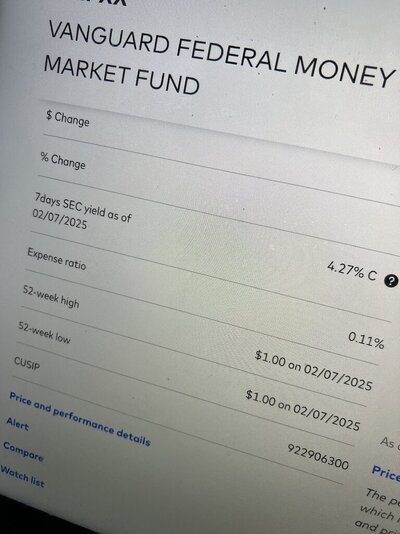

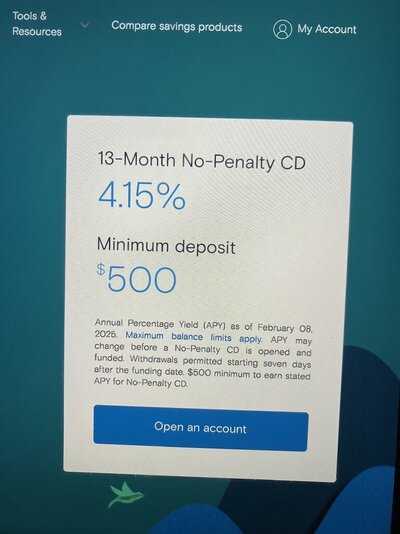

He acted like he made $300k and 25% more .This is what you do with your safe money you want liquidity on . Goldman Sachs ( Marcus bank )13 month no penalty cd 4.15% ( can take full amount out any time ) . Great money mkt vanguard 4.27% . Can move money in 24 hrs . I love Goldmans as it's so easy to move money quickly and setting payable on death beneficiaries easy to do . What I like the most is being able to direct a yr ahead of time were the money goes when the cd matures . With all other banks you get a letter in theHis state probably caps at $300,000 and they didn't pay any extra. It's all state by state.

Mail and it's pia to call and setup transfer . You have to remember to call in the 10 days after it matures . With Goldman it automatically transfers to the account you designate well ahead of time . When your juggling 20-30 cd's that's big

Attachments

- 5,262

Plus,most seniors are in 0% or low tax brackets, so CDs are better for those individuals than NQ Annuities even if same interest rate. Makes no sense to defer income taxes until death on a NQ annuity when you are in 0% or 10% bracket if your beneficiaries will owe much larger taxes on gains on lump sum death benefit.He acted like he made $300k and 25% more .This is what you do with your safe money you want liquidity on . Goldman Sachs ( Marcus bank )13 month no penalty cd 4.15% ( can take full amount out any time ) . Great money mkt vanguard 4.27% . Can move money in 24 hrs . I love Goldmans as it's so easy to move money quickly and setting payable on death beneficiaries easy to do . What I like the most is being able to direct a yr ahead of time were the money goes when the cd matures . With all other banks you get a letter in the

Mail and it's pia to call and setup transfer . You have to remember to call in the 10 days after it matures . With Goldman it automatically transfers to the account you designate well ahead of time . When your juggling 20-30 cd's that's big

I wish some annuity carriers would allow the taxable interest to be reported each year. With standard deduction nearing 30k for a married couple over age 65, many of them would be better off raising their taxable income to get the tax reporting done now instead of at death

- 19,845

I saw a training video this week where they said to sell an FE policy to your annuity clients to pay the taxes.Plus,most seniors are in 0% or low tax brackets, so CDs are better for those individuals than NQ Annuities even if same interest rate. Makes no sense to defer income taxes until death on a NQ annuity when you are in 0% or 10% bracket if your beneficiaries will owe much larger taxes on gains on lump sum death benefit.

I wish some annuity carriers would allow the taxable interest to be reported each year. With standard deduction nearing 30k for a married couple over age 65, many of them would be better off raising their taxable income to get the tax reporting done now instead of at death

- 5,262

sure, that could be true in regard to a person of modest means having a smaller 401k or IRA balance & a small face FE might pay some taxes.................but a tiny bit of help from their tax preparer could help them shift up to $30k a year out of the IRA funds or Annuity to elminate or reduce the tax due at death on qualified funds or non-qualified gains. Again, not everyone fits that scenario, but IRS stats are very clear that the large majority of seniors over age 70 no longer owe any federal taxes as the standard deduction wipes away most or all taxable incomeI saw a training video this week where they said to sell an FE policy to your annuity clients to pay the taxes.

1035 those annuities into an LTC annuity.I wish some annuity carriers would allow the taxable interest to be reported each year. With standard deduction nearing 30k for a married couple over age 65, many of them would be better off raising their taxable income to get the tax reporting done now instead of at death

If you use it for LTC, bang, no taxes.

If not, you're right back where you started anyway.

- 5,262

Yup. Problem for some is age & insurability.1035 those annuities into an LTC annuity.

If you use it for LTC, bang, no taxes.

If not, you're right back where you started anyway.

Similar threads

- Replies

- 59

- Views

- 6K

- Replies

- 68

- Views

- 8K

- Replies

- 22

- Views

- 716

- Replies

- 6

- Views

- 857

- Replies

- 7

- Views

- 820