Kenneth Busch

Expert

- 35

The workshop approach is better in my opinion. You conduct it at a local community college or library. This eliminates anyone looking to just get fed.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

The workshop approach is better in my opinion. You conduct it at a local community college or library. This eliminates anyone looking to just get fed.

Caveat, not an agent.

It also seems to me that his topic is far too specific for a workshop process of attempting to start a relationship between prospects needing tax or financial advice, and the potential advisor.

If you have something to offer, why do you think the secure act would make any difference?

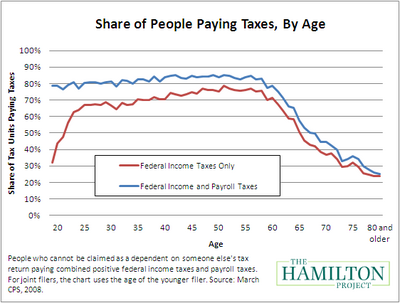

That way they avoid taking money out after they retire in a likely lower tax brackets then they are currently in while working?

So far no one has indicated they have either success or failure doing dinner Seminars for retirement. My intention is to give people who are within 3-5 years from retiring or ones that have retired in that last few years with funds still in a qualified plan an option to convert to a Roth Plan.

I agree with him when he says that if you retire to a lower tax bracket than you were in while working, you have failed financially.

You, personally, should be in a much lower bracket because all of your withdrawals will be coming out of your Roth 401k and your over-funded whole life...

Right. But most folks aren't doing that, are they? As a matter of fact, it is showing them that what they want and what they are infact doing don't line up that gets them looking at max-funded whole life as an alternative.

But still, if you're living on $100K+, what happens on your 65th birthday that suddenly makes $60K "a good living?" And if you are going to have just $60K, would you rather have it as $60K taxable, or $60K tax-exempt.

Too many financial advisors justify their fees by simply saying "well you'll be in a lower tax bracket" and the sheeple nod and follow.