Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

GUL question

- Thread starter New kid

- Start date

- 29,491

Nobody has ever found out.What happens after 121th birthday with a policy that has maturity age up to 121y

Thank you

https://en.wikipedia.org/wiki/List_of_American_supercentenarians

Last edited:

- 2,113

And as soon as one does they'll raise it to 122.

- 10,330

What happens after 121th birthday with a policy that has maturity age up to 121y

Thank you

Most policies will endow at that point. Meaning they pay out the benefit to the Policy Owner while still living.

While nobody has reached 121 yet. Plenty have reached 100, and Im sure there have been polices that have endowed as a result of that.

Last edited:

- 4,576

Bigger issue for the millions of active policies that have age 100 as max maturity date. Unless a carrier has created & had approved by regulators a Maturity Extension Rider, the owner receives the cash value at maturity along with a tax bill on any gains in the policy. Also, if they have loans against the policy, they can even get a tax bill for way, way, way more than the cash value they receive because IRS considers all the loan interest they were charged in the calculation of gains.

Soooooo, age 121 is not as much of an issue as the very real issue being played out today with the policies issued prior to 2004 when the mortality tables expanded past age 100. not all carriers issue to age 120 today as some still have age 100 max. UL/IUL can even have issues as the COI gets extremely high when you are 119 & 40 years past life expectancy

Ask each carrier how they treat life maturity of age 100 or 120 & if they allow the maturity to be extended in some fashion. If so, is it at the current face amount or does the face amount at maturity drop to equal the cash value merely so the client can keep it open & not be taxed on gains.

I hear some agents use the age 120 as a reason to 1035 exchange older contracts that mature at age 100, but some fail to explain that extending maturity to age 120 isnt always in the clients best interest unless the policy is performing well & growing as some that would have matured at age 100 can/will lapse at 100.3 or 101, etc

Soooooo, age 121 is not as much of an issue as the very real issue being played out today with the policies issued prior to 2004 when the mortality tables expanded past age 100. not all carriers issue to age 120 today as some still have age 100 max. UL/IUL can even have issues as the COI gets extremely high when you are 119 & 40 years past life expectancy

Ask each carrier how they treat life maturity of age 100 or 120 & if they allow the maturity to be extended in some fashion. If so, is it at the current face amount or does the face amount at maturity drop to equal the cash value merely so the client can keep it open & not be taxed on gains.

I hear some agents use the age 120 as a reason to 1035 exchange older contracts that mature at age 100, but some fail to explain that extending maturity to age 120 isnt always in the clients best interest unless the policy is performing well & growing as some that would have matured at age 100 can/will lapse at 100.3 or 101, etc

- 11,278

I'm going to respectfully disagree with @scagnt83 . Whole life policies will mature and endow (cash values = death benefits). UL policies will simply terminate. Any cash values remaining would be refunded to the policyholder.

A couple of articles regarding UL and age 100:

[EXTERNAL LINK] - Joseph M. Belth: No. 226: The Age 100 Problem—The Achilles' Heel of Life Insurance—Lands in Court.

https://www.forbes.com/advisor/life-insurance/age-100-problem/

A couple of articles regarding UL and age 100:

[EXTERNAL LINK] - Joseph M. Belth: No. 226: The Age 100 Problem—The Achilles' Heel of Life Insurance—Lands in Court.

https://www.forbes.com/advisor/life-insurance/age-100-problem/

- 4,576

UL policies will simply terminate.

each contract varies I believe

I recall seeing some that say at age 100 the face amount changes to be equal to cash value. So, a $100,000 policy with $27,000 cash value will drop to be a $27,000 policy that stays active, but endows to be equal to cash value

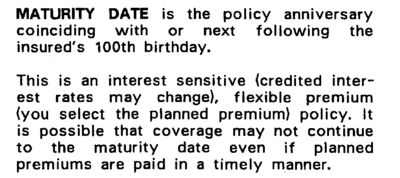

Here is 1 from 1980s that says at age 100 (birthday) both the insurance & cash value are paid:

But same carrier in same contract from 1980 later defines maturity as the anniversary after turning age 100.

This is a from a court case because when the client turned 100 the policy was still active & hadnt matured. $50k face amount & $10k of Cash value..........but you can imagine the COI for age 100. $10k wasnt enough to keep it active from age 100 until the 10 months later when it matured at annivesary, so it lapsed, meaning nothing owed. Because "at age 100" wasnt defined, ambiguity went to consumer & carrier had to pay the $50,000 plus 10,000 cash value that was there at age 100 birthday.

This will happen even more with UL contracts with 120 maturity that dont have no lapse guarantee paid to age 120. Pushing maturity to age 120 on UL products doesnt necessarily benefit the consumer as many seem to believe. Extremely well funded UL/IUL definitely are better with 120 than 100 as was in the past & WL to 120 can be better by not forcing taxable payout to owner at 120.

Different UL policy issued in 2002. this one says death benefit(not death benefit & cash value) & is paid at maturity (anniversary after age 100), so client could have policy lapse after age 100 but before anniversary.

Policy from 2005. Maturity not mentioned, but says at policy anniversary after age 100, the death benefit changes to be equal to the cash value for both the level & increasing death benefit option & then continues on without a forced taxable payout. So, a $100k UL with $20K CV at anniversary after age 100 will change to be a $20k face amount policy

So, there you have it....................................................it depends on exact contract language of any given policy by any given carrier & I am sure it varies as much with age 120 contracts as age 100 & even within the same carrier depending on what years/versions were purchased.

Keep your E&O tail coverage up to date

Lloyds of Lubbock

Guru

- 714

" Whole life policies will mature and endow (cash values = death benefits). "

Not all whole life policies have maturity provisions.

Try finding one in a Guardian policy.

When the cash value equals the death benefit, Guardian will hold on to the money (unless asked not to)and credit with interest.

At the time of death they will pay it out as a death claim.

Not all whole life policies have maturity provisions.

Try finding one in a Guardian policy.

When the cash value equals the death benefit, Guardian will hold on to the money (unless asked not to)and credit with interest.

At the time of death they will pay it out as a death claim.

Last edited:

- 10,330

To summarize this whole thread: read the contract.

- 4,576

before or after selling it?To summarize this whole thread: read the contract.

Amazing how difficult it is to get some carriers to locate a specimen contract or specimen rider/endorsement to read to see how it matches the marketing materials or the talking points of the wholesaler, etc

Similar threads

- Replies

- 12

- Views

- 1K