Captain Sensible

New Member

- 1

Hi - I hope someone here might be able to offer an opinion - not expecting legal advice, just an opinion as to whether my understanding is correct, and whether legal advice might be required.

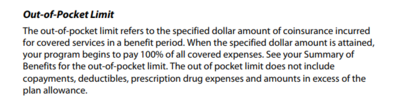

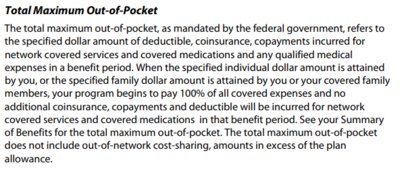

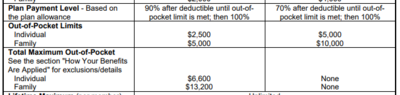

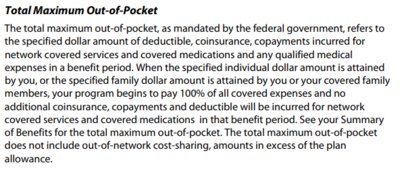

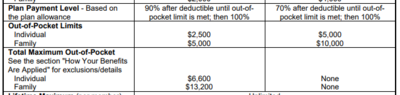

My wife has an individual health plan, and in the policy it is spelt out that it has a $1000 deductible and then an Out of Pocket Limit of $2500 and also, a Total Maximum Out of Pocket of $6600. Her benefit plan document says the following about the Plan Payment Level (in relation to coinsurance): "90% after deductible, until out of pocket limit is met, then 100%". In the same document, on the very next line, the Out of Pocket Limit is specified as $2500. This is shown in the attached files along with the description of the terms used from the policy itself.

Her insurance company seem confused by this and are claiming that she has to pay co-insurance up to the $6600 figure but I believe that this figure, which it includes co-insurance, would not have co-insurance applied to it after the lower Out of Pocket limit figure is met. At that point, only co-pays and prescription charges would count towards it.

Any thoughts or comments would be appreciated. Thank you for your time.

My wife has an individual health plan, and in the policy it is spelt out that it has a $1000 deductible and then an Out of Pocket Limit of $2500 and also, a Total Maximum Out of Pocket of $6600. Her benefit plan document says the following about the Plan Payment Level (in relation to coinsurance): "90% after deductible, until out of pocket limit is met, then 100%". In the same document, on the very next line, the Out of Pocket Limit is specified as $2500. This is shown in the attached files along with the description of the terms used from the policy itself.

Her insurance company seem confused by this and are claiming that she has to pay co-insurance up to the $6600 figure but I believe that this figure, which it includes co-insurance, would not have co-insurance applied to it after the lower Out of Pocket limit figure is met. At that point, only co-pays and prescription charges would count towards it.

Any thoughts or comments would be appreciated. Thank you for your time.