- 379

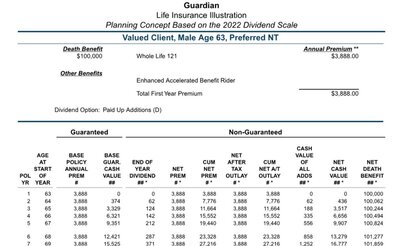

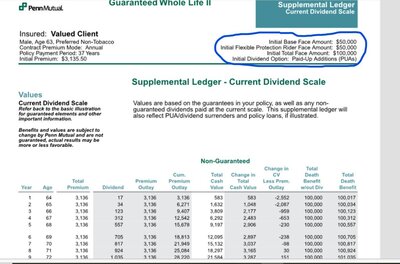

I need to get a quote for a male 63 preferred and standard.

Face amount 100,000.

I have Compulife, and looking at the GUL, the premium

would be $220 per month standard and $188 preferred.

I just don't have ready access to Whole life quotes from

top WL companies to compare with.

Looks like he wants this for death benefit purposes.

GUL may be the best option, but I would show him

comparisons.

Input appreciated.

Shooter

Face amount 100,000.

I have Compulife, and looking at the GUL, the premium

would be $220 per month standard and $188 preferred.

I just don't have ready access to Whole life quotes from

top WL companies to compare with.

Looks like he wants this for death benefit purposes.

GUL may be the best option, but I would show him

comparisons.

Input appreciated.

Shooter