polarbear99

New Member

- 13

What's the best company with a basic IUL for a healthy child 12 and under?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

2 possibilities in my mind, but with the caveat that parents better be fully protected themselves, have their emergency fund & saving tons for their own retirement in 401k/Roth/their own IUL/College 529Silly Question Im sure - but Why would a healthy 12 year old want an Indexed Universal Life Insurance policy?

Agree! Fund a simple plan, then look for a set aside investment... this leaves the parents with additional options as opposed to locked in long term commitment.Imo, WL works much better for children

THIS! sjm2 possibilities in my mind, but with the caveat that parents better be fully protected themselves, have their emergency fund & saving tons for their own retirement in 401k/Roth/their own IUL/College 529

If all of the above is true, I find 2 scenarios where it might work. $250k face example, but can be lower face amounts depending on carrier offerings:

1. Low cost no lapse guarantee IUL with guaranteed insurability rider to guarantee their insurability. Basically a no lapse UL or IUL is forever term insruance. The GIR rider many times allows the child to increase their face amount every 3-5 years from the time they are 25 to 45 even if uninsurable. IE: could buy $250k of coverage for less than $50 per month & guaranteed to age 120.

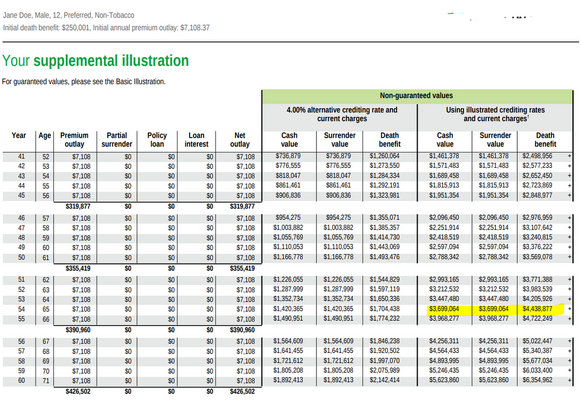

2. If parents have the resources & high income/high net worth, they can buy an Accumulation focused IUL with the lowest minimum face amount & the maximize overfunding every year to keep it below the IRS MEC rules. That policy could eventually have hundreds of thousands of dollars of cash value, if not millions to be there if needed for home purchase, supplement retirement, etc. IE: $250k face amount will legally fit $7,000 per year into it. Projects to have $3-4M at projected crediting & current costs of insurance. View attachment 16871

There are extended no lapse guarantee options on some IULs, which would make overfunding redundant though. sjmI just don't jump into the UL/IUL vs. WL discussion any longer, other than to say one thing -- no matter how you fund any UL-chassis product, fund it to the max!!! -- you are still shifting risk back to the insured/owner.

Just Rolls right off the tongue. Might be a great way to get someone on the airline seat right next to you to engage in a long conversation!Low cost no lapse guarantee IUL with guaranteed insurability rider to guarantee their insurability. Basically a no lapse UL or IUL is forever term insruance. The GIR rider many times allows the child to increase their face amount every 3-5 years from the time they are 25 to 45

Lol, you think I am a commoner. I lean left & promote climate change, so I fly private jet when I travel to avoid taking to humansJust Rolls right off the tongue. Might be a great way to get someone on the airline seat right next to you to engage in a long conversation!