Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

IULs or investment accounts for my kids?

- Thread starter Mdeleon1

- Start date

Well IUL is not a one and done strategy, and even if you max fund it you still have costs so not all the cash is earning interest. You will need to structure payments for quite a while to make it work effectively.I have 3 kids ages 23, 13 and 5.

I have 10k for each one to either invest or open IUL. I do not have enough knowledge regarding IULs to determine if the cash value benefits are better than investment accounts.

Any information would be greatly appreciated!

Investments will likely earn more than an IUL over time, but you have more risk and the up's and down's to deal with. $10k one time will grow nicely over time, but not likely turn into a massive amount of money that way either. Rule of 72... $10k would only be $80k in 30yrs at 7.2%. You can do the math.

Also, comparing the two... its apples and oranges. Make sure you get solid info from someone who is licensed to sell both, not just from an insurance agent. IMHO, most folks should use both vehicles - investments AND perm life insurance.

Lloyds of Lubbock

Guru

- 746

Also the 13 and 5 year old will not be written at preferred rates so the COI is more.

"Well IUL is not a one and done strategy"

If you are to plunk down 10k with no further premiums, I don't think an insurance policy would be your best strategy.

"Well IUL is not a one and done strategy"

If you are to plunk down 10k with no further premiums, I don't think an insurance policy would be your best strategy.

DON'T touch IUL with a 10 foot pole period. I am telling you from personal experience and I am not an agent.I have 3 kids ages 23, 13 and 5.

I have 10k for each one to either invest or open IUL. I do not have enough knowledge regarding IULs to determine if the cash value benefits are better than investment accounts.

Any information would be greatly appreciated!

You are in luck. Stock market is nicely down 30%. Just buy SPY or QQQ and your kid's future will be well taken care of.

Lloyds of Lubbock

Guru

- 746

Still relevant

Term Life Insurance Rebuttal: The Laughing Banker

--original story by Benjamin N. (Woody) Woodson, CLU, Life Trustee of LUTC and re-printed from Managers Magazine.

I entered the manager’s office of my neighborhood bank and made this proposal:

“Mr. Bank Manager, there is a piece of vacant land in my area that I’m interested in buying. It is well-suited, the town is developing in its direction, and I am virtually certain that its value will rise. I’ve thought the matter out carefully from every angle and I’ve come to the conclusion that the land would be a very good buy.” “There are several reasons why I prefer the prospective capital gains of a vacant lot to the current cash income I could have by buying another type of property, such as an apartment building.” “For example, I don’t particularly need a supplementary income at the moment, because these are the best earning years of my life.” “Also, the extra income that I would receive from income-producing property would, in any case, be cut considerably by the income tax I would have to pay.” “For these reasons, I think that the purchase of this land is a good-buy – provided I can be sure that its value will increase over the years, enough to represent a good return on the investment I make.” “Since I don’t want to lose money on this enterprise, I’d like to make an agreement with you and your bank that will protect me financially and give me security and peace of mind.” “The purchase price of the land is $28,000. If I buy it at that price, I want to have a written guarantee from your bank to protect me on several points.” Specifically: “I want your guarantee that the property will be worth $100,000 in 35 years (at which time I’ll be age 65) and that the bank will buy it from me at that price.” “I’m prepared to accept a reasonable shrinkage in its immediate value if I decide to sell within the next few years; such shrinkage is to be expected in the case of a long-term investment such as this." "However, I want – this early-sale clause notwithstanding – the guarantee that, each year, the land will have a market value proportionate to the $100,000 it will be worth in 35 years, and that the bank will buy it back from me at that value at any time I wish.” “In the event of my death, whenever this occurs (in three days, three months, or three years), I want your guarantee that the bank will pay to my heirs the full $100,000 that the land will be worth in 35 years.” “I want your bank (in the event of my death) to absorb any capital gains tax that would be chargeable, so that my heirs will receive the $100,000 without paying any income tax.” “I want the bank to consent to be trustee and to administer (without charge) the proceeds from the sale of this land, either for my heirs in the event of my death or for myself if I so desire, and I want the bank to guarantee the principal and interest.” “I want the bank to absorb maintenance costs and any taxes that could be levied against the land during the years I am the owner.” “I want the bank to give me the privilege of buying this lot in installments over a period of 20 years, if I should decide to do so, rather than paying the $28,000 in cash. In this way, I would make 20 level annual payments at about 6 percent interest, so that each annual payment would be about $2,200.” “Finally, in the event of my death before the end of the 20-year period, I want the bank to cancel the remaining payments and deliver the $100,000 ultimate value guaranteed by the bank to my heirs.” “Mr. Manager, if the bank accepts these conditions, I will buy that piece of land. What do you think?” The bank manager laughed. Then he told me that he didn’t think a financial institution could comply with my wishes under such conditions. Yet, as you probably guessed by now, all I did was describe a $100,000 permanent life insurance policy. It is a policy that can be purchased with a single premium or over a 20 year period. Life insurance is one of the best contracts ever conceived. It is what you offer your clients.

Term Life Insurance Rebuttal: The Laughing Banker

--original story by Benjamin N. (Woody) Woodson, CLU, Life Trustee of LUTC and re-printed from Managers Magazine.

I entered the manager’s office of my neighborhood bank and made this proposal:

“Mr. Bank Manager, there is a piece of vacant land in my area that I’m interested in buying. It is well-suited, the town is developing in its direction, and I am virtually certain that its value will rise. I’ve thought the matter out carefully from every angle and I’ve come to the conclusion that the land would be a very good buy.” “There are several reasons why I prefer the prospective capital gains of a vacant lot to the current cash income I could have by buying another type of property, such as an apartment building.” “For example, I don’t particularly need a supplementary income at the moment, because these are the best earning years of my life.” “Also, the extra income that I would receive from income-producing property would, in any case, be cut considerably by the income tax I would have to pay.” “For these reasons, I think that the purchase of this land is a good-buy – provided I can be sure that its value will increase over the years, enough to represent a good return on the investment I make.” “Since I don’t want to lose money on this enterprise, I’d like to make an agreement with you and your bank that will protect me financially and give me security and peace of mind.” “The purchase price of the land is $28,000. If I buy it at that price, I want to have a written guarantee from your bank to protect me on several points.” Specifically: “I want your guarantee that the property will be worth $100,000 in 35 years (at which time I’ll be age 65) and that the bank will buy it from me at that price.” “I’m prepared to accept a reasonable shrinkage in its immediate value if I decide to sell within the next few years; such shrinkage is to be expected in the case of a long-term investment such as this." "However, I want – this early-sale clause notwithstanding – the guarantee that, each year, the land will have a market value proportionate to the $100,000 it will be worth in 35 years, and that the bank will buy it back from me at that value at any time I wish.” “In the event of my death, whenever this occurs (in three days, three months, or three years), I want your guarantee that the bank will pay to my heirs the full $100,000 that the land will be worth in 35 years.” “I want your bank (in the event of my death) to absorb any capital gains tax that would be chargeable, so that my heirs will receive the $100,000 without paying any income tax.” “I want the bank to consent to be trustee and to administer (without charge) the proceeds from the sale of this land, either for my heirs in the event of my death or for myself if I so desire, and I want the bank to guarantee the principal and interest.” “I want the bank to absorb maintenance costs and any taxes that could be levied against the land during the years I am the owner.” “I want the bank to give me the privilege of buying this lot in installments over a period of 20 years, if I should decide to do so, rather than paying the $28,000 in cash. In this way, I would make 20 level annual payments at about 6 percent interest, so that each annual payment would be about $2,200.” “Finally, in the event of my death before the end of the 20-year period, I want the bank to cancel the remaining payments and deliver the $100,000 ultimate value guaranteed by the bank to my heirs.” “Mr. Manager, if the bank accepts these conditions, I will buy that piece of land. What do you think?” The bank manager laughed. Then he told me that he didn’t think a financial institution could comply with my wishes under such conditions. Yet, as you probably guessed by now, all I did was describe a $100,000 permanent life insurance policy. It is a policy that can be purchased with a single premium or over a 20 year period. Life insurance is one of the best contracts ever conceived. It is what you offer your clients.

ejbarraza

Expert

- 65

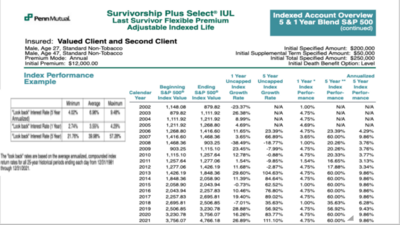

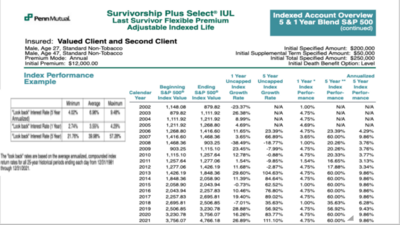

If you go with a PennMutual Survivorship IUL for you and your 5 year old it will cut costs in half and grow massively. They have a 1.1% guaranteed floor rate and a 5-year index option that is capped at 60% with a minimum guarantee of 15% for the 5 years so a minimum return of 3% annualized. If you dollar cost average the premium payments every month it will mitigate the sequence of returns risk. Also, the cash value can be collateralized for a secured bank line of credit. For example, a certain bank (has the same initials as a caucasian rapper/chocolate candy) offers quarterly interest-only payments on PennMutual IULs. With a 75% loan to value. So what I would do if I were you is put $5k per year for 10 years and use the line of credit from year 3 onwards to pay for the life insurance premiums. Also, if interest rates keep rising cap rates can increase as well. For instance, the cap on this 5-year index option is currently 60% plus a 15% multiplier making a potential total return of 66%. Before 2010 the cap rate was 90% which after you include the multiplier is a potential return of 99% month over month. Your line of credit would grow by 75% of the dividend growth.

Last edited:

- 2,356

.

I have 10k for each one to either invest or open IUL.

I am not a financial advisor, but what type of investment account are you considering?

- 6,986

If you go with a PennMutual Survivorship IUL for you and your 5 year old it will cut costs in half and grow massively. They have a 1.1% guaranteed floor rate and a 5-year index option that is capped at 60% with a minimum guarantee of 15% for the 5 years so a minimum return of 3% annualized. If you dollar cost average the premium payments every month it will mitigate the sequence of returns risk. Also, the cash value can be collateralized for a secured bank line of credit. For example, a certain bank (has the same initials as a caucasian rapper/chocolate candy) offers quarterly interest-only payments on PennMutual IULs. With a 75% loan to value. So what I would do if I were you is put $5k per year for 10 years and use the line of credit from year 3 onwards to pay for the life insurance premiums. Also, if interest rates keep rising cap rates can increase as well. For instance, the cap on this 5-year index option is currently 60% plus a 15% multiplier making a potential total return of 66%. Before 2010 the cap rate was 90% which after you include the multiplier is a potential return of 99% month over month. Your line of credit would grow by 75% of the dividend growth.

View attachment 7942

Caveat, not an agent.

Just a reminder, op was talking about managing a one-time lump sum, not a stream of cash flows.

ejbarraza

Expert

- 65

If the maximum amount of contributions is $10,000, then do not get any permanent life insurance policy. However, if you are willing to deposit $5,000 Year 1 and 2 and borrow using an indexed loan years 3-5, then; that is the better route to take. Just my 2 cents of course.Caveat, not an agent.

Just a reminder, op was talking about managing a one-time lump sum, not a stream of cash flows.

Lloyds of Lubbock

Guru

- 746

If the maximum amount of contributions is $10,000, then do not get any permanent life insurance policy. However, if you are willing to deposit $5,000 Year 1 and 2 and borrow using an indexed loan years 3-5, then; that is the better route to take. Just my 2 cents of course.

How long have you been selling life insurance...just curious

How long have you been selling life insurance...just curious

Similar threads

- Replies

- 43

- Views

- 18K

- Replies

- 40

- Views

- 38K

- Replies

- 40

- Views

- 41K