My dad retired with a ira 25 yrs ago . Started taking end’s at age 70 . He’s 91 now . His ira was $500 k in 1999 .His rmd’s big now because he’s lives far longer than the avg distribution table . Because of tremendous returns his Ira’s still near $500 k even after 21 years of distributions . My question will they force his distributions s high if he lives another 5 yrs the account goes to zero fast ? The irs wants there tax money . They dint want this passing as inheritance

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Questions about rmd’s

- Thread starter DonP

- Start date

- 4,576

My dad retired with a ira 25 yrs ago . Started taking end’s at age 70 . He’s 91 now . His ira was $500 k in 1999 .His rmd’s big now because he’s lives far longer than the avg distribution table . Because of tremendous returns his Ira’s still near $500 k even after 21 years of distributions . My question will they force his distributions s high if he lives another 5 yrs the account goes to zero fast ? The irs wants there tax money . They don't want this passing as inheritance

Actually, IRS knows most seniors pay little or no federal tax, so thd IRS would rather have the large balance pass at his death to kids who may still be working & would be pushed into higher tax brackets with a large lump sum fully taxable inheritance.

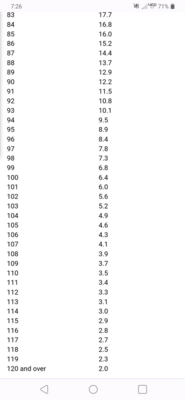

If he is 91 this year & last 12/31/2022 his balance was $500k, you divide 500k by 11.5, so he would have to take at least $44k for his RMD. See attached IRS table, he will only divide his 12/21/2023 balance by 10.8. so, he won't have to empty it to zero for a long time(but could have much smaller RMD if it loses a lot on investment side)

Lastly, if he owns an Annuity IRA, most annuities mature at age 99 or 100, so the Annuity IRA could end & force it all out in that 1 year. But because it is an IRA, he could roll it at maturity to a non Annuity IRA like a bank IRA or brokerage IRA. (That isnt an option for non qualified annuities where someone lives to 99 or 100 & they get a huge tax surprise when a non qualified annuity matures

Attachments

- Thread starter

- #3

Actually, IRS knows most seniors pay little or no federal tax, so thd IRS would rather have the large balance pass at his death to kids who may still be working & would be pushed into higher tax brackets with a large lump sum fully taxable inheritance.

If he is 91 this year & last 12/31/2022 his balance was $500k, you divide 500k by 11.5, so he would have to take at least $44k for his RMD. See attached IRS table, he will only divide his 12/21/2023 balance by 10.8. so, he won't have to empty it to zero for a long time(but could have much smaller RMD if it loses a lot on investment side)

Lastly, if he owns an Annuity IRA, most annuities mature at age 99 or 100, so the Annuity IRA could end & force it all out in that 1 year. But because it is an IRA, he could roll it at maturity to a non Annuity IRA like a bank IRA or brokerage IRA. (That isnt an option for non qualified annuities where someone lives to 99 or 100 & they get a huge tax surprise when a non qualified annuity matures

So the % he has to take out actually declines as he gets older ? So let’s say his account stays at $500 k for the next 5 yrs his rmd’s actually decline year by year . Actually this is only about 2% of his assets . He makes $250k a yr in a pension and has 34 cd’s .

- 4,576

So the % he has to take out actually declines as he gets older ? So let’s say his account stays at $500 k for the next 5 yrs his rmd’s actually decline year by year . Actually this is only about 2% of his assets . He makes $250k a yr in a pension and has 34 cd’s .

No, the RMD goes up. Like anything with the government, they make a 1 step process 2 or 3 steps. Instead of just putting a % in the chart, they give you a number you use as the divisor in the equation. So, if the number is 25 & you have 100k, you divide 100k by their life expectancy number of 25 in the chart....$4000. theu could have just said multiply by 4%.

So, this year your dad is 11.5, which is 8.695%. next year, the factor is 10.8, which is 9.3%......so, the RMD is actually required to be more & more each year as a percentage of the entire pot of money

He really needs to see an attorney & good CPA to do some tax planning/gifting, etc.. if he gives any money to church or charity each year, it might be better to have it sent directly from his IRA so that it never shows on his tax return as income, etc

- Thread starter

- #5

No, the RMD goes up. Like anything with the government, they make a 1 step process 2 or 3 steps. Instead of just putting a % in the chart, they give you a number you use as the divisor in the equation. So, if the number is 25 & you have 100k, you divide 100k by their life expectancy number of 25 in the chart....$4000. theu could have just said multiply by 4%.

So, this year your dad is 11.5, which is 8.695%. next year, the factor is 10.8, which is 9.3%......so, the RMD is actually required to be more & more each year as a percentage of the entire pot of money

He really needs to see an attorney & good CPA to do some tax planning/gifting, etc.. if he gives any money to church or charity each year, it might be better to have it sent directly from his IRA so that it never shows on his tax return as income, etc

Thats not happening . We tried for a decade to get him to give substantial money to us kids . We tried to get him to do trusts . He refuses . He wants to control his money in his name . Anything under $13 mil is not taxable .He can write a check write now for $12.92 million to us kids tax free and use his whole exemption . He has us on all cd’s payable on death .

- 1,953

One question is how did he accumulate so much wealth?

Not subject to estate taxes but it's certainly subject to income taxes...to you if he passes it to you.Thats not happening . We tried for a decade to get him to give substantial money to us kids . We tried to get him to do trusts . He refuses . He wants to control his money in his name . Anything under $13 mil is not taxable .He can write a check write now for $12.92 million to us kids tax free and use his whole exemption . He has us on all cd’s payable on death .

- Thread starter

- #8

Not subject to estate taxes but it's certainly subject to income taxes...to you if he passes it to you.

He can gift $12.92 million right now and there’s no taxes . Anything over $17k you have to file on your taxes . It goes against his $12.92 million lifetime exclusion . Nobody pays any taxes . Example he writes me check for $5 mil . He files on his taxes . He still has $7.92 mil lifetime exclusion left when he dies .

- 6,462

The factors Allen Trent gave you come from a table in the back of IRS Pub 590b.So the % he has to take out actually declines as he gets older ? So let’s say his account stays at $500 k for the next 5 yrs his rmd’s actually decline year by year . Actually this is only about 2% of his assets . He makes $250k a yr in a pension and has 34 cd’s .

You can't change ownership on an IRA like that. An IRA cannot be given to another person.He can gift $12.92 million right now and there’s no taxes . Anything over $17k you have to file on your taxes . It goes against his $12.92 million lifetime exclusion . Nobody pays any taxes . Example he writes me check for $5 mil . He files on his taxes . He still has $7.92 mil lifetime exclusion left when he dies .

You're talking about the gift tax/estate tax exclusion. I'm talking about income taxes.

Similar threads

- Replies

- 41

- Views

- 4K

- Replies

- 110

- Views

- 23K