- Thread starter

- #11

Prakash Gaonkar

New Member

- 6

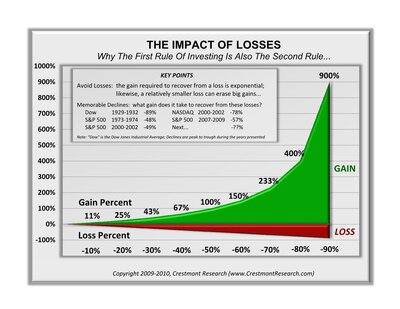

Here is what you are missing? Will your client have the discipline to continue with their contributions when the market falls and the cash value of their VUL declines 50%. What happens if it declines just before they plan to need it? VULs are a riskier option.

Certainly not all clients. That is why, VUL is not a Suitable for all the clients. But that does not mean it is not suitable for some knowledgeable clients. And trust me, Knowledgeable clients are increasing every year. The cloud is bringing more info and knowledge to masses which was Protected/Guarded all along to keep Job security of many White collars.

The 80s era of wall street OR Insurance is gone.