- 687

Re: Whole Life VS Index Universal Life

When I am illustrating an overfunded IUL the max rate I show is 6%. I will then state the possibilities with a 6.5% but that is as high as I go. I just don't believe that I can illustrate an 8% with a clear conscience.

While I believe the product "may" work, the problem that I have is the amount of time these products have been on market, the percentage of owners/insured that have had their products long enough to actually begin taking distribution while having stopped making premium payments is an unknown, and the actual percentage that will lapse due to improper funding, improper illustrations, and/or unrealized expectations from the market is an unknown.

While I am sold, I am not drinking the koolaid with as much sugar. For this reason, I still like whole life for its guarantees a whole lot more. Then again I may be all wrong in my thinking with regard to this.

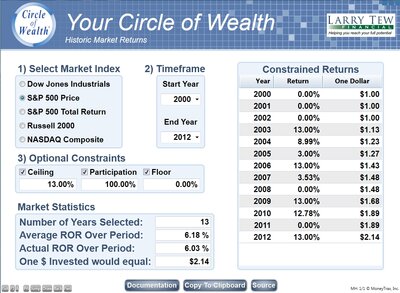

The difference between 6 and 8% can be the nearly double the cash after 30 years...

I would love to see your last point. The -38 wouldn't necessarily kill the policy since you'd have a 0 credit that year and then could recover and cap out in subsequent years. A 2000-2002 scenario when the client is in his 70s, hasn't made a premium payment in years and is taking distributions would be very interesting.

When I am illustrating an overfunded IUL the max rate I show is 6%. I will then state the possibilities with a 6.5% but that is as high as I go. I just don't believe that I can illustrate an 8% with a clear conscience.

While I believe the product "may" work, the problem that I have is the amount of time these products have been on market, the percentage of owners/insured that have had their products long enough to actually begin taking distribution while having stopped making premium payments is an unknown, and the actual percentage that will lapse due to improper funding, improper illustrations, and/or unrealized expectations from the market is an unknown.

While I am sold, I am not drinking the koolaid with as much sugar. For this reason, I still like whole life for its guarantees a whole lot more. Then again I may be all wrong in my thinking with regard to this.