- 4,605

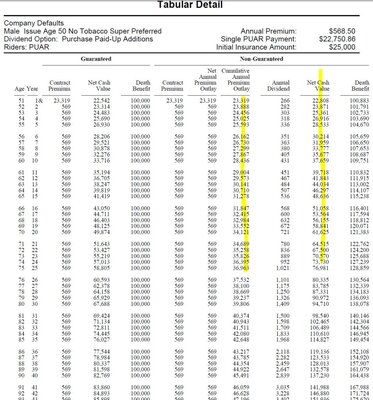

Quit paying. Show me ANY whole life policy that leaves you with a better cost base versus term if both are cancelled withing 10 years. Love to see an example with numbers.

The devil is in the details.

So, everyone that lapses in say yr 5 no longer needs coverage & is still insurable when they reapply?

I will send you an illustration from WL 6 months ago with very small WL base & max funded PUAR MEC. That same money in term policy & a mutual fund today would be worse off after load fees & market losses. But I don't think that is a realistic or fair comparison.....just like how you are so singular focused on insurance for all being always in a perfect vacuum with perfect clients & perfect decisions. If you are always focused on cheapest, they should buy ART so they don't overpay for 20 or 30 yr if they cancel or don't need any more