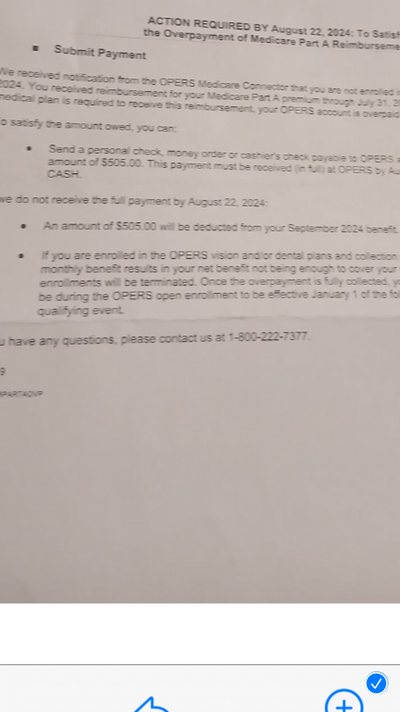

This Individual retired from the state of Ohio . I didn’t even know he had state coverage . He was paying $280 for a med sup with no Part D coverage for 12 yrs . He wanted a mapd . What is the $505 state is asking him back for ? What is reimbursement of the $505 Part A for the month ? Makes no sense . If he worked for the state he had free part A . Ok I read up on it . If you started with the state before 1986 you paid no Medicare taxes . The state pays your part A premium . I wrote him a mapd . He has coverage . If we send in proof of coverage won’t they continue paying his part A ? He had an outside Humana med sup and they paid his Part A.

Attachments

Last edited: