Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Colorado Bankers (CB Life)...

- Thread starter FETalk

- Start date

- 19,289

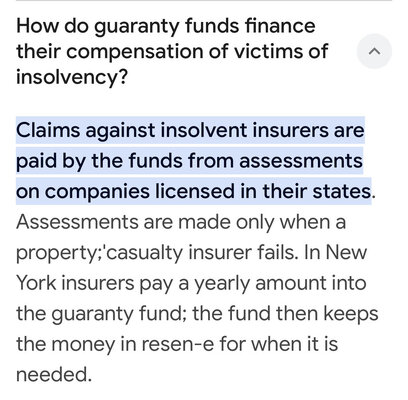

No they won’t.Right I meant to say the liquIdation will recoup some of the money but the state Insurance guaranty associations will recoup the remaining from the other insurance companies.

They are not a collection agency.

They will tell the companies what to pay.

With no enforcement abilities if they don’t.

- 19,289

It is. It’s far better if someone buys the company.sounds like a lengthy process itself

Looks like no one wants this company.

David Nyman

Expert

- 36

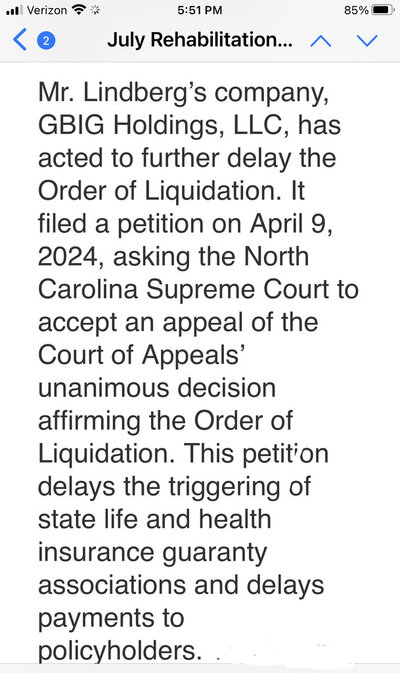

North Carolina allowed Lindberg to raid the coffers of the insurance companies. Most states have limits on how much policy holders money can be used to fund other Lindberg companies, yachts, and houses. North Carolina had no limits!! That's why Lindberg moved companies from Florida to take advantage of this loop hole. Lindberg then bribed the insurance commissioner to change office personnel to assign someone that would be more flexible and allow him to steal more. Since the insurance commissioner is funded from licensing fees paid by insurance companies licensed in that state I feel there is a conflict of interest.

No they won’t.

They are not a collection agency.

They will tell the companies what to pay.

With no enforcement abilities if they don’t.

This is starting to sound worst and worst.

David Nyman

Expert

- 36

This is a failure on many levels.

1. Lindberg

2. Insurance commissioner for allowing such bad companies to do business in north Carolina. Where is the oversight? Isn't it the purpose of having a state insurance regulatory agency?

3. The State guarantee association for their lack of any guarantee. These insurance companies have been in default for 5 years without any money from the SGA. They should have something like the FDIC.

4. The rating agency. Just like the housing crisis the rating agencies don't give an accurate indication of the risk involved in an investment.

5. The insurance agent that sold me this piece of crap and misrepresented the risk ( lpl financial and agent Jake Mann) then backed away and said they had no liability.

1. Lindberg

2. Insurance commissioner for allowing such bad companies to do business in north Carolina. Where is the oversight? Isn't it the purpose of having a state insurance regulatory agency?

3. The State guarantee association for their lack of any guarantee. These insurance companies have been in default for 5 years without any money from the SGA. They should have something like the FDIC.

4. The rating agency. Just like the housing crisis the rating agencies don't give an accurate indication of the risk involved in an investment.

5. The insurance agent that sold me this piece of crap and misrepresented the risk ( lpl financial and agent Jake Mann) then backed away and said they had no liability.

Citizens Bank sold thousands of these high risk policies from Linburg in New England and pass them along as guarantee and safe retirement investments. When we approach Citizens bank for help, they claim there nothing they will do for the customers who they sold the annuities to under false pretense. The truth is, these annuities are high risk and no guarantee, a lot of senior citizens felt for this scheme because they were living off the higher interest. There should be a warning label when buying these annuities just like cigarettes.

Similar threads

- Replies

- 10

- Views

- 2K

- Replies

- 45

- Views

- 3K