- 26,745

Have a 5 year old with an insulin pump (diabetes diagnosed age 2) riding 10k on a 50k term policy out of contestability.

Policy owner wants to ditch the term for WL but does not want dich it unless she can either.....

1.Get CWL for the 5 year old.

2.Take out WL and add the 5 year old as a rider.

Rider has been declined by LBL due to insulin pump.

I don't write riders or much CHL.

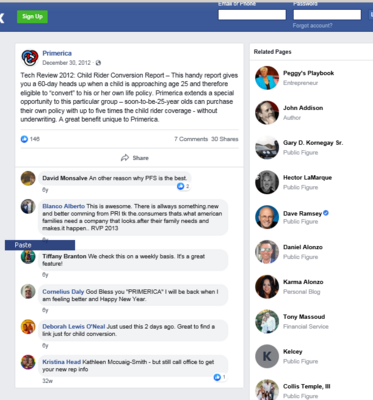

Convert the Child rider.

Convert the base term if a good option available.

Have here keep the term and max convert the child rider when she ages out. Probably the best option.

What's the best way to put this one together ?