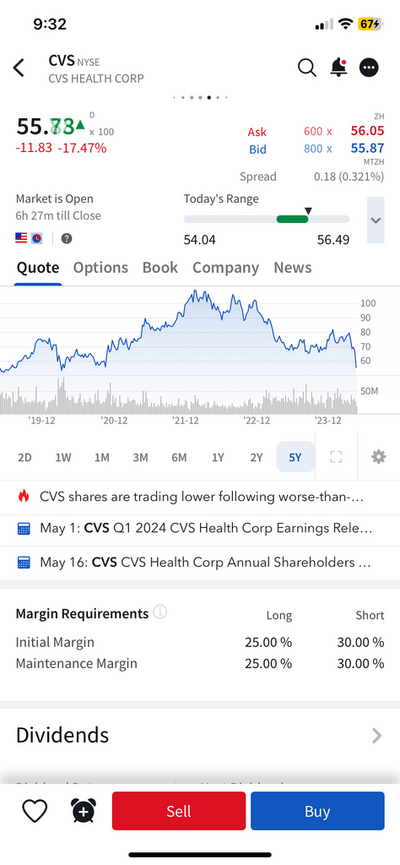

Loss ratios skying in Medicare overall .This is hitting all CO’s .Cvs stock tanked to a many yr low . Yesterday Assurance IQ shut its doors on the spot throwing 1000 plus brokers out of business overnight . As this talk of fmo overrides , marketing money etc might be moot . If the mapd business has become somewhat unprofitable carriers might slash commissions and overrides anyway .In all the yrs since Mapd started this will be a the most challenging yr in 2025 for insurers and brokers .

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

It’s not just Humana . CVS Aetna just had disaster qtr.

- Thread starter DonP

- Start date

Loss ratios skying in Medicare overall .This is hitting all CO’s .Cvs stock tanked to a many yr low . Yesterday Assurance IQ shut its doors on the spot throwing 1000 plus brokers out of business overnight . As this talk of fmo overrides , marketing money etc might be moot . If the mapd business has become somewhat unprofitable carriers might slash commissions and overrides anyway .In all the yrs since Mapd started this will be a the most challenging yr in 2025 for insurers and brokers .

Wait, I read on this forum from someone else that this was mainly a Humana issue. How could it have possibly caused issues for Aetna as well?

For those wondering, CVS net income fell to $1.12 billion in Q1 2024, down from $2.14 billion in Q1 2023. They also lowered guidance for 2024 EPS to $7 per share which is down from prior guidance of $8.30 per share.

- Thread starter

- #3

It was a mostly Humana issue till today . Anthem said nothing about this as there stock skied after earnings .United had ok earnings and mentioned this . But now it seems to be spreading industry wideWait, I read on this forum from someone else that this was mainly a Humana issue. How could it have possibly caused issues for Aetna as well?

For those wondering, CVS net income fell to $1.12 billion in Q1 2024, down from $2.14 billion in Q1 2023. They also lowered guidance for 2024 EPS to $7 per share which is down from prior guidance of $8.30 per share.

- Thread starter

- #4

It was a mostly Humana issue till today . Anthem said nothing about this as there stock skied after earnings .United had ok earnings and mentioned this . But now it seems to be spreading industry wide

Nah, it wasn't "mostly" a Humana issue until today. Aetna is just now reporting their earnings. It was an issue prior to the report. And with UHC mentioning it as well, those are the 3 largest MAPD carriers. It's an MAPD issue which is a result of higher utilization and lower than expected increase in reimbursement from CMS.

- Thread starter

- #6

Nah, it wasn't "mostly" a Humana issue until today. Aetna is just now reporting their earnings. It was an issue prior to the report. And with UHC mentioning it as well, those are the 3 largest MAPD carriers. It's an MAPD issue which is a result of higher utilization and lower than expected increase in reimbursement from CMS.

Anthem sure didn’t mention it much . There stock hit all time high recently . United loss ratio not near as high as Humana’s . Just traded 20k cvs for 64 cents or $12k plus profit . Nice long move off $54 to $55.20 . I think I’ll take the day off

ValeRosso

Guru

- 612

I never knew CVS and Aetna has separate stock tickers, guess I never really thought about it

%Yeah CVS is down to a 2 year low, tanked 17$ today, however Aetna stock is at all time highs.

%Yeah CVS is down to a 2 year low, tanked 17$ today, however Aetna stock is at all time highs.

- Thread starter

- #8

Thats incorrect. CVS owns Aetna and there’s 1 stock symbol . Cvs was at $55 in 2020 but $54 looks like a low going back to 2013I never knew CVS and Aetna has separate stock tickers, guess I never really thought about it

%Yeah CVS is down to a 2 year low, tanked 17$ today, however Aetna stock is at all time highs.

InsuranceGuy29

Guru

- 769

This isn’t correct. Aetna’s stock ticker symbol is “AET,” and CVS’s is “CVS.” Aetna is technically owned by CVS but it’s a completely separate operation and division. They’re still basically separate and distinct companies. Aetna is extremely well-run. CVS has had well-documented issues for the past few years. They are restructuring their brick and mortar store businesses, and that’s why the stock is lower. It has nothing to do with Aetna or Medicare Advantage. Aetna’s earnings and growth are through the roof.Thats incorrect. CVS owns Aetna and there’s 1 stock symbol . Cvs was at $55 in 2020 but $54 looks like a low going back to 2013

Last edited:

Similar threads

- Replies

- 48

- Views

- 7K

- Replies

- 18

- Views

- 1K