I've seen an uptick in this specifically related to SNF. I had 3 MAPD clients last year who either had their request for SNF denied or greatly limited (two denied, one limited to 6 days). And on all of these plus a few more who used SNF after a hospital stay, the SNF facility encouraged these patients to go back to original Medicare and get a Med Supp. I understand why the facility encourages it, but this also shows their ignorance since the patient obviously can't get a Med Supp.

One of the more frustrating things we deal with as agents is when a client gets bad info/advice from an admin person at a doctors office or facility. The patient believes the people at the doctors office know what they are talking about because they deal with insurance claims. Many times they don't have a clue. Even worse, the admin person is adamant they know what they are talking about when they are clearly misinformed.

Had the same issue (doc says get a Medigap and then we can proceed). Not so much with SNF because I am not aware of this other than with a new client where it came up.

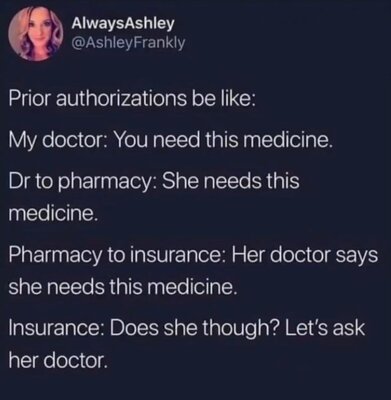

I had a lady, about a year ago, that needed an MRI before the surgeon would operate due to spinal stenosis. Aetna MAPD giving doc the run around and repeat denials for pre-authorization. After 5 months of this nonsense he told her to come back when she had a Medigap.

My rule is, I won't practice medicine if the providers stop giving insurance advice.