- 10,806

The problem with "new forms of insuring against LTC" is not that the new forms have less risk. The problem is the "new forms" (which are really nothing but new packaged versions of overpriced cash value life insurance) is the cost of the new forms.

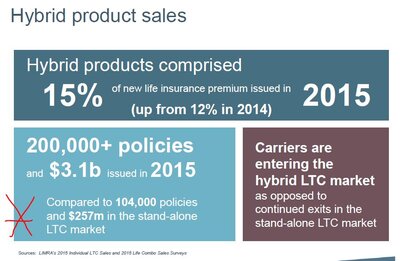

If hybrids cost the same as traditional LTCi, there would be no market for traditional LTCi and hybrids would be selling like crazy.

Hybrids typically costs 2x to 4x what a traditional LTCi policy costs. AARP got it right:

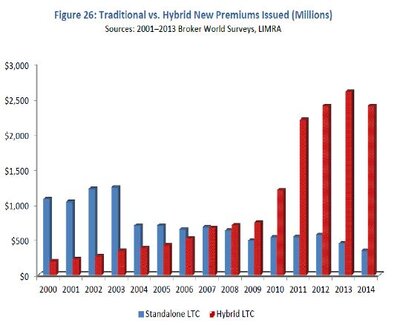

What makes you think hybrids arent selling like crazy?

It all depends on your definition of cost. Most consumers do not consider it a cost when they have liquid access to their premiums plus interest.