- Staff

- #4,031

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Political Humor

- Thread starter wehotex

- Start date

By using the term "the Left" rather than "them" or "us", you imply you are on the "Right", yet have attempted to tell this forum you are neutral. Good luck with that. lolIn 2016 and 2020 the Left were crying that Trump would have us in a Nuclear War.

- Staff

- #4,033

- Staff

- #4,034

- Staff

- #4,035

- 2,797

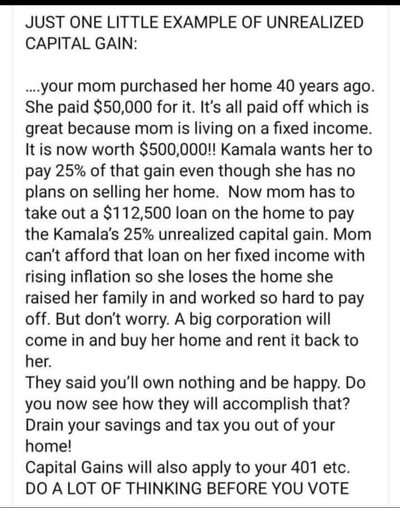

More bullshit fear mongering. The unrealized capital gains tax (if it even ever gets passed) isn't going to affect Mom and her $500,000 house.

It's designed for people whose income and assets are more than $100 million.

It's designed for people whose income and assets are more than $100 million.

Harris tax proposal only for those with net worth above $100 million | Fact check

A proposal to tax assets that increase in value, even if they are not being sold, would only apply to people with a net worth above $100 million.

www.usatoday.com

You actually believe if the pass the unrealized Capital Gains Tax it will remain at those limits. The original 1913 income tax was set at 1% for those making in excess of $95k (inflation adjusted) and a 6% surcharge on those incomes over $15.8 million. Average earners would never be taxed (according to the proponents).. How is that working out for you?More bullshit fear mongering. The unrealized capital gains tax (if it even ever gets passed) isn't going to affect Mom and her $500,000 house.

It's designed for people whose income and assets are more than $100 million.

Harris tax proposal only for those with net worth above $100 million | Fact check

A proposal to tax assets that increase in value, even if they are not being sold, would only apply to people with a net worth above $100 million.www.usatoday.com

- Staff

- #4,038

- 10,805

Only if mom has a net worth of over $100,000,000.00

- 10,805

You actually believe if the pass the unrealized Capital Gains Tax it will remain at those limits. The original 1913 income tax was set at 1% for those making in excess of $95k (inflation adjusted) and a 6% surcharge on those incomes over $15.8 million. Average earners would never be taxed (according to the proponents).. How is that working out for you?

Taxing the top 1% is what led to the creation of the middle class in this country.

Revoking those taxes, has led to the destruction of the middle class over the past 30 years.

Similar threads

- Replies

- 132

- Views

- 8K

- Replies

- 1

- Views

- 583

- Replies

- 5

- Views

- 639

- Replies

- 0

- Views

- 573

- Replies

- 0

- Views

- 522