Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

POLL: Are you updating subsidies?

- Thread starter kgmom219

- Start date

Truce

Expert

- 93

My ACA clients are in PA and NJ, both of which created state based exchanges for 2021, and neither of which is ready to accept ARPA changes yet. This week I'll probably send an email (already created) to all my ON exchange clients with a link to the law's highlights and a calculator provided by PA. I say probably because the calculator is based on a silver plan that only a few of my clients use, and the numbers it spits out would just confuse people. The state of PA is claiming that they will notify every On ex member with an estimate of how their premium could change.....once this actually happens I'll decide how to follow up with them.

More important is the OFF exchange people. Both states use Silver loading on exchange so it's very important to CHOOSE whether to apply off or on exchange based on estimated income. They can't just apply ON exchange , pay full price, and reconcile when they file, unless they are choosing a plan that has the same cost off / on exchange.

The most popular plan in each market (on and off exchange version) IS indeed silver loaded.

I am meticulous about weigning the pros and cons of ON exchange plans (with a higher retail cost BUT eligible for discounts).....vs a lower cost identical OFF ex plan that is not eligible for discounts. See example below using the SAME NJ plan for a family with two 40 y/o parent and two 2 y/o kids:

Family of four with $100K AGI: Easy call, go for the ON ex discount because the $700/ mo discount is bigger than the $150/mo "inflated" increase compared to off ex version of the plan. Gross Premium over $1300. Net Premium $500/mo

Family of four with 200K AGI. Easy call. Go OFF ex since you are never going to get a tax credit and it's best to save the extra $150/mo by avoiding the silver loading of the exchange. Premium under $1200

Family of four with $150K AGI. Now it gets fun. In December I would have told them to go OFF ex since they make far above the threshold of getting a discount. Now that their is no income limit and an 8.5% threshold, they could get a discount of about $400/mo. This $400/mo discount exceeds the $150/mo silver loading excess, and now they could go ON exchange and save some $$$. I spoke to a rep at the insurer who said they would carry over deductibles from OFF to ON exchange for people who make the move....but they are not required to by state law. Grrrrrrrrr. New net premium $900. Prior premium just under $1200.

I'll do the work to notify the people who benefit (or could potentially benefit) from going ON exchange. If they want to make a change, I'll do it. It will be a big deal for a few dozen families, freeing up cash to save (and further reduce AGI) or spend on other things. It's no fun to redo work done in the fall, but it is what it is and that's the nature of the under 65 market.

More important is the OFF exchange people. Both states use Silver loading on exchange so it's very important to CHOOSE whether to apply off or on exchange based on estimated income. They can't just apply ON exchange , pay full price, and reconcile when they file, unless they are choosing a plan that has the same cost off / on exchange.

The most popular plan in each market (on and off exchange version) IS indeed silver loaded.

I am meticulous about weigning the pros and cons of ON exchange plans (with a higher retail cost BUT eligible for discounts).....vs a lower cost identical OFF ex plan that is not eligible for discounts. See example below using the SAME NJ plan for a family with two 40 y/o parent and two 2 y/o kids:

Family of four with $100K AGI: Easy call, go for the ON ex discount because the $700/ mo discount is bigger than the $150/mo "inflated" increase compared to off ex version of the plan. Gross Premium over $1300. Net Premium $500/mo

Family of four with 200K AGI. Easy call. Go OFF ex since you are never going to get a tax credit and it's best to save the extra $150/mo by avoiding the silver loading of the exchange. Premium under $1200

Family of four with $150K AGI. Now it gets fun. In December I would have told them to go OFF ex since they make far above the threshold of getting a discount. Now that their is no income limit and an 8.5% threshold, they could get a discount of about $400/mo. This $400/mo discount exceeds the $150/mo silver loading excess, and now they could go ON exchange and save some $$$. I spoke to a rep at the insurer who said they would carry over deductibles from OFF to ON exchange for people who make the move....but they are not required to by state law. Grrrrrrrrr. New net premium $900. Prior premium just under $1200.

I'll do the work to notify the people who benefit (or could potentially benefit) from going ON exchange. If they want to make a change, I'll do it. It will be a big deal for a few dozen families, freeing up cash to save (and further reduce AGI) or spend on other things. It's no fun to redo work done in the fall, but it is what it is and that's the nature of the under 65 market.

They are spending millions of $$$ by hiring an additional hc.gov workforce to give people a buck now which they'd get anyway in a few months. That's how our tax dollars are wasted. Another reason the whole "update your app thing" is wrong; we are expected to work for free. Am I the only one who sees it this way?

Markets and industries always change and there always comes a time where you need to save/service your existing book just to keep/maintain current income.

This ARPA change is also an opportunity to grow your book in this mass land grab happening.

I'm doing both. Hope to come out even with STM loss that is imminent.

This ARPA change is also an opportunity to grow your book in this mass land grab happening.

I'm doing both. Hope to come out even with STM loss that is imminent.

- Staff

- #15

ok....so this is what I am doing....sending out email's .......

As you may or may not know but the American Rescue Plan Act of 2021 is now in effect and it has expanded subsidies which means you now can pay less for your health insurance. Now here is the catch,you have to resubmit an application. So what could go wrong? Well I have had a few clients that did this and now they have to submit verification of income by July. So if you want me to set you up with the lower premium I will do it for you and if you come back with an income verification tag will also help you with getting that taken care of. Let me know what you want to do.

As you may or may not know but the American Rescue Plan Act of 2021 is now in effect and it has expanded subsidies which means you now can pay less for your health insurance. Now here is the catch,you have to resubmit an application. So what could go wrong? Well I have had a few clients that did this and now they have to submit verification of income by July. So if you want me to set you up with the lower premium I will do it for you and if you come back with an income verification tag will also help you with getting that taken care of. Let me know what you want to do.

ok....so this is what I am doing....sending out email's .......

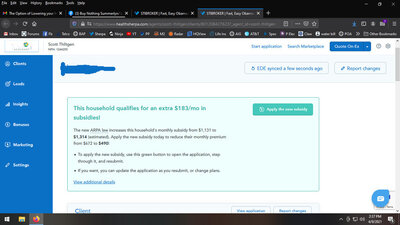

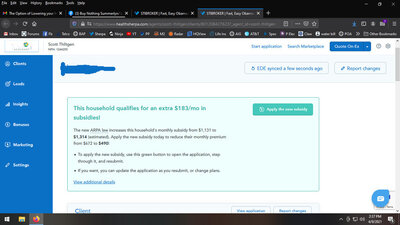

As you may or may not know but the American Rescue Plan Act of 2021 is now in effect and it has expanded subsidies which means you now can pay less for your health insurance. Now here is the catch,you have to resubmit an application. So what could go wrong? Well I have had a few clients that did this and now they have to submit verification of income by July. So if you want me to set you up with the lower premium I will do it for you and if you come back with an income verification tag will also help you with getting that taken care of. Let me know what you want to do. View attachment 6972

Thats what i was scared of and why i haven't done it . With self employed people thats trickier . If their do a refund at tax time they'll get it back then.

I have updated subsidies with some and others wanted to leave alone, they would settle at tax time.

I did notify each insured by mail and phone call so I did take action.

Another development regarding this. One of my insureds contacted me today who is a subsidized client and informed me that the Marketplace automatically re-enrolled him into the same plan and insurer he had but they automatically applied the increased subsidy. My client did not initiate this nor approve of it. The Marketplace automatically re-enrolled him with the increased subsidy and the only reason he found out was they sent a letter to him confirming the change. My agent name was removed but apparently my NPN might still be attached.

Does the Marketplace have the authority and right to update a consumers subsidy amount during the American Rescue Act SEP without the insureds authority or approval? This seems like a highly illegal act by the Marketplace

I did notify each insured by mail and phone call so I did take action.

Another development regarding this. One of my insureds contacted me today who is a subsidized client and informed me that the Marketplace automatically re-enrolled him into the same plan and insurer he had but they automatically applied the increased subsidy. My client did not initiate this nor approve of it. The Marketplace automatically re-enrolled him with the increased subsidy and the only reason he found out was they sent a letter to him confirming the change. My agent name was removed but apparently my NPN might still be attached.

Does the Marketplace have the authority and right to update a consumers subsidy amount during the American Rescue Act SEP without the insureds authority or approval? This seems like a highly illegal act by the Marketplace

I have updated subsidies with some and others wanted to leave alone, they would settle at tax time.

I did notify each insured by mail and phone call so I did take action.

Another development regarding this. One of my insureds contacted me today who is a subsidized client and informed me that the Marketplace automatically re-enrolled him into the same plan and insurer he had but they automatically applied the increased subsidy. My client did not initiate this nor approve of it. The Marketplace automatically re-enrolled him with the increased subsidy and the only reason he found out was they sent a letter to him confirming the change. My agent name was removed but apparently my NPN might still be attached.

Does the Marketplace have the authority and right to update a consumers subsidy amount during the American Rescue Act SEP without the insureds authority or approval? This seems like a highly illegal act by the Marketplace

They did that to a whole bunch of mine and have a whole bunch that didn't want to do that.

Similar threads

- Replies

- 4

- Views

- 2K

- Replies

- 4

- Views

- 2K

- Replies

- 11

- Views

- 3K

- Replies

- 13

- Views

- 4K