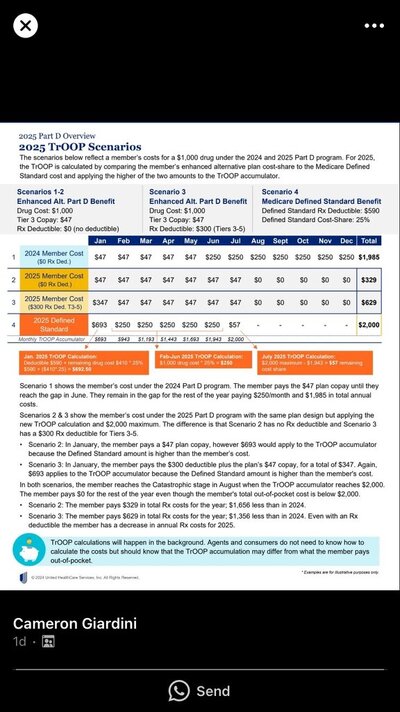

Saw this online . Supposedly there’s enchanced and basic plans that price drugs differently to consumer? Nobody really knows exactly what expenses count toward a person moop .So in reality the $2000 max out of pocket can be reached when a client pays far less than the $2000as examples 2,3 and 4 show . There’s no real way for an agent to calculate these. It’s done in the background

Attachments

Last edited: