- 10,805

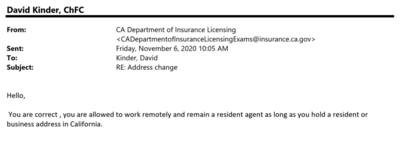

As far as Non-Resident applications went for me, NY just took a crazy amount of time. CA was nit picky about a letter of explanation and demanded it be dated within the past 12 months... which held up the processing for 2 weeks. Im not sure why they need the letter dated within the past 12 months when the incident happened 20 years ago... but it is what it is. Just wish they had told me that on the front end.