Mary Combs

New Member

- 10

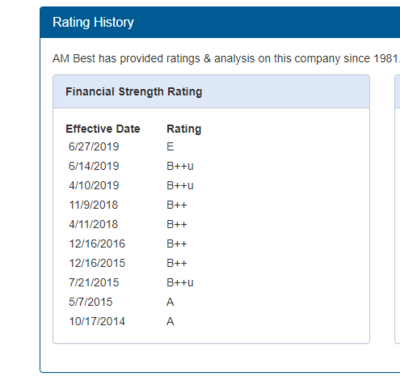

I am another annuity victim of Colorado Banker's Life. I signed up for quarterly updates on the rehabilitation.

I have not received an update this quarter. Has anyone else received an update?

I have not received an update this quarter. Has anyone else received an update?