What new statement of CBLife web site

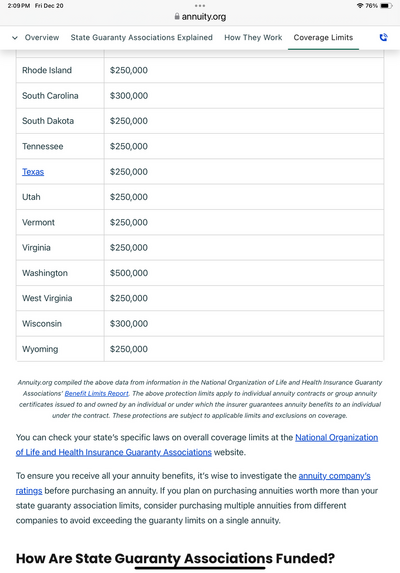

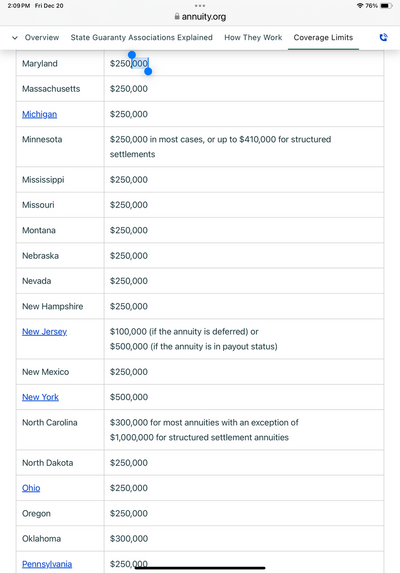

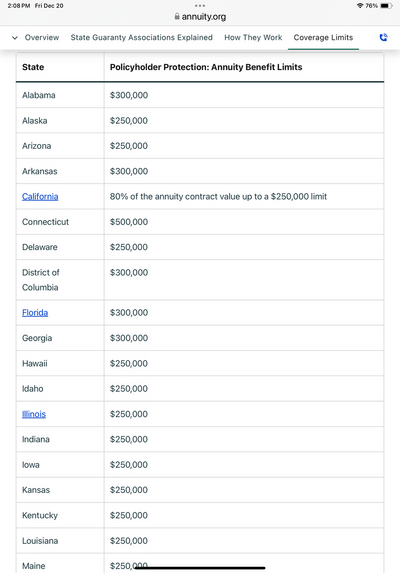

Colorado Bankers Life Insurance Company ("CBL"or the "Company") is in court-ordered liquidation effective as of November 30, 2024. The North Carolina Insurance Commissioner is the court-appointed Liquidator. When a liquidation is ordered, each state's life and health insurance guaranty association provides coverage to the Company's policyholders who are residents of that state up to the coverage limits specified by state laws. CBL's policy obligations are now covered by various state life and health insurance guaranty associations subject to applicable statutory limits and requirements. Any policy benefit amounts above the state's life and health insurance guaranty association coverage limits become claims against the Company's remaining assets, after all administrative expenses are paid. The login above is for the portion of your policy that is not covered by a state guaranty association. It will become active in January of 2025. A separate link for the covered portion of your policy will be available when it becomes active.

Colorado Bankers Life Insurance Company ("CBL"or the "Company") is in court-ordered liquidation effective as of November 30, 2024. The North Carolina Insurance Commissioner is the court-appointed Liquidator. When a liquidation is ordered, each state's life and health insurance guaranty association provides coverage to the Company's policyholders who are residents of that state up to the coverage limits specified by state laws. CBL's policy obligations are now covered by various state life and health insurance guaranty associations subject to applicable statutory limits and requirements. Any policy benefit amounts above the state's life and health insurance guaranty association coverage limits become claims against the Company's remaining assets, after all administrative expenses are paid. The login above is for the portion of your policy that is not covered by a state guaranty association. It will become active in January of 2025. A separate link for the covered portion of your policy will be available when it becomes active.